The Ultimate Guide to Advisor Managed Accounts

- Participants Want Value. Enter Advisor Managed Accounts.

- So, what is an Advisor Managed Account anyway?

- What are the benefits of Managed Accounts?

- What is the measurable impact of Advisor Managed Accounts?

- Target-Date Funds or Advisor Managed Accounts. We say both.

- What are QDIAs and how do Managed Accounts fit in?

- Managed Accounts in a Hybrid QDIA

Retirement planning solutions, especially those offered by employers, can evolve over time. A solution may fall in or out of favor based on the regulatory environment, new research, culture shifts or technology developments. Target-date funds, for example, have been a popular solution for nearly three decades due to their simplicity and overall effectiveness. (We’ll talk more about TDFs later in this article.)

In recent years, there has been a rise in the number of people attempting a Do-It-Yourself approach to their retirement. Some feel their retirement plan advisor offers lackluster advice. Others believe they can beat benchmarks better on their own. Whatever their motivation, the bottom line is that a growing number of people are opting to go it alone, rather than work with their retirement plan advisor, because they seek greater value.

Studies from both Vanguard and Morningstar show that these assumptions around the value of an advisor by plan participants are oftentimes erroneous. Vanguard’s “Putting a Value on Your Value” study found that a retirement plan advisor, providing cogent wealth management through financial planning, discipline, and guidance can produce as much as a 3 percent net benefit beyond a do-it-yourself investor.

In Morningstar’s 2013 paper, “Alpha, Beta, and now…Gamma,” their researchers demonstrated that a retirement planning solution brought to bear by advisors that encompasses “gamma” factors, such as tax-efficient asset location, total wealth asset allocation, dynamic withdrawal strategies that adjust for life expectancy and market performance, and help with decisions about whether to purchase an annuity, was able to generate an income level that was more than 20 percent higher than a retirement planning solution that didn’t incorporate these factors. It’s important to note that this research should be used as a data point and not conclusive evidence of the benefit derived from any specific financial plan for any specific individual.

Participants Want Value. Enter Advisor Managed Accounts.

While the solutions to help plan participants save for retirement may evolve, the fundamental questions people ask about their own retirement have remained the same for generations.

- How much income will I need in retirement?

- How much should I contribute each year?

- When can I retire?

- How should my savings be invested, and how should that change over time?

Participants need help, and there is a growing body of research that shows advisor managed accounts can not only answer their fundamental questions about retirement but may even improve outcomes for those individuals.

So, what is an Advisor Managed Account anyway?

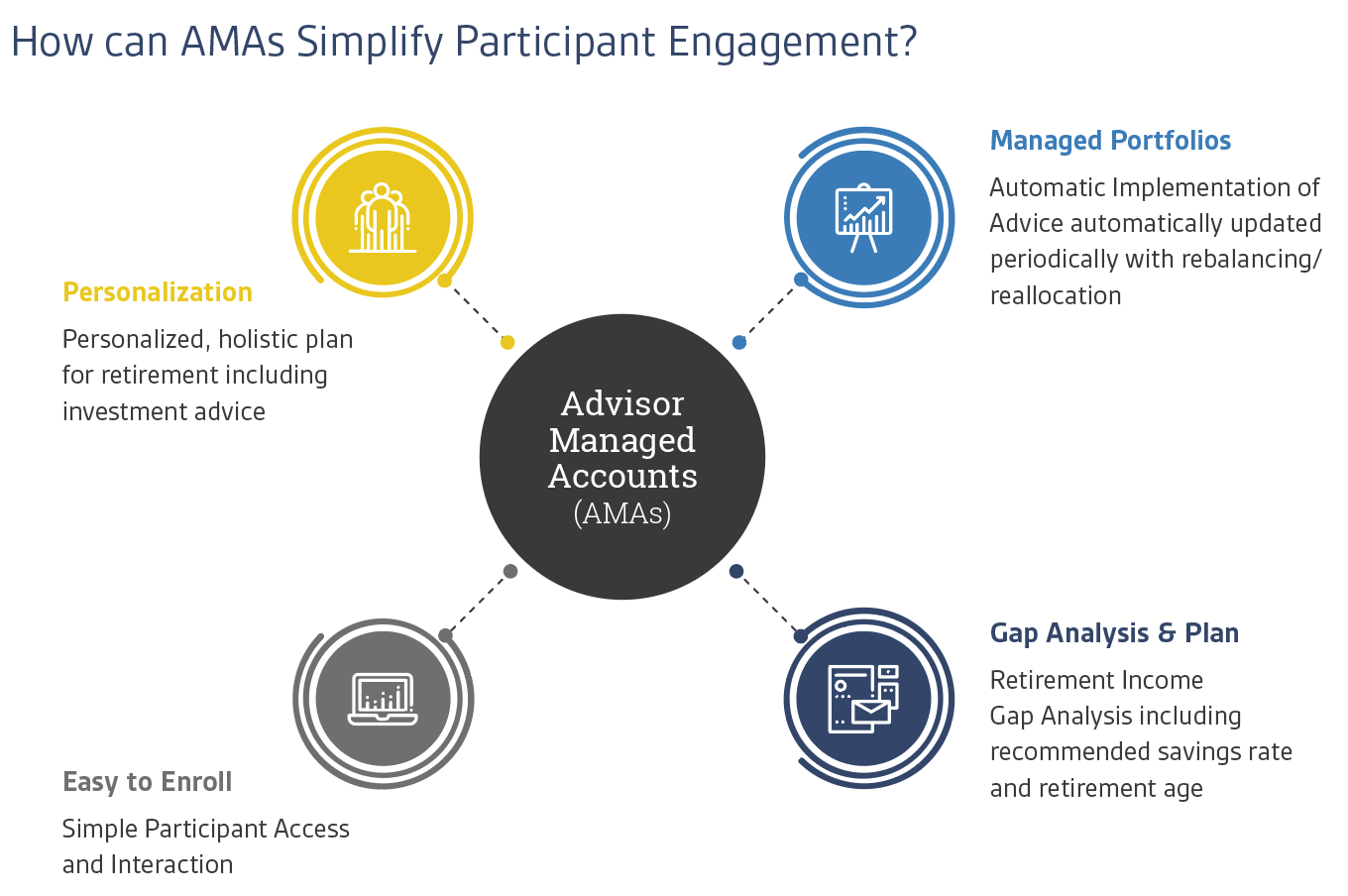

While Advisor Managed Accounts, or AMAs, are not new, we get quite a few questions about what Managed Accounts are and how they work. Quite simply, an Advisor Managed Account is a goals-based retirement planning solution that includes a recommended savings rate and retirement age, investment advice and ongoing asset management. Because the advisor has what’s called discretionary authority over the account, they can automatically implement the participant’s personalized investment advice, then adjust the investment mix automatically over time as the participant’s unique circumstances change.

An advisor managed account should meet the following four criteria:

- Participant-level 3(38) protection – A registered investment advisor (RIA) offers the service and acts as a fiduciary to the plan participants.

- Personalized, holistic plan for retirement – The recommended savings rate, retirement age, investment mix, and glide path must take into account characteristics of the participant, such as current age, desired retirement age, account balance, savings rate, pension, social security, retirement assets outside of the plan and/or risk tolerance.

- Ongoing discretionary investment management – The solution must have the authority to automatically implement the advised investment mix, including periodic updates to that investment mix as the participant’s situation changes over time.

- Engagement and client support – Whether online, over the phone, and/or by speaking to another human being, participants must have a way to engage the solution such that they can view and update the data used to generate their advice, and understand the advice and recommendations they receive.

What are the benefits of Managed Accounts?

Advisor Managed Accounts are gaining momentum in the retirement plan space, in part, because they help create a personalized savings and investment plan for participants. The individual’s goals are determined using multiple data points, including age, salary, savings rate, expected retirement age and more. The employee benefits package is enhanced by:

- Personalization – Even an “average” investor has needs, goals, and circumstances that are unique to them. Advisor Managed Accounts tailor the advice to the individual.

- Better Projected Outcomes – Advisor Managed Accounts help a participant implement their personalized plan, which includes advice and recommendations for achieving their retirement income goal.

- Integration – The participant experience is seamless, including the support and connectivity we have all come to expect from our services.

- Full Lifecycle Support – From accumulation to decumulation, Advisor Managed Accounts support the full retirement lifecycle, to and through retirement.

What is the measurable impact of Advisor Managed Accounts?

Did you catch that part in the previous section where we mentioned advisor managed accounts may improve outcomes for plan participants? We thought that might grab your attention. Let’s dig into that a bit with some data.

A 2019 Morningstar study, “The Impact of Managed Accounts on Participant Savings and Investment Decisions”, looked at 60,825 Morningstar Retirement Manager℠ defined contribution (DC) participants over an 11-year period. The study’s results are compelling. Of the participants who were categorized as “off track”, 71 percent increased their savings rate, and they did so by nearly 33 percent (or 2 percent of salary). Additionally, the percentage of participants maximizing the employer match increased by 12 percent.

Further, the average wealth at retirement increased by 47 percent for previously off-track participants. And the average 30-year old could have almost 56 percent more annual retirement income, assuming a 0.40 percent annual fee.

In 2020, NextCapital released a report, “The Value Add of Managed Advice”, focused on Advisor Managed Accounts. Their findings showed that the estimated value add of Managed Advice is 0.95 percent (95 bps) per year, excluding the value of contributions and retirement age recommendations. The estimated value add increases from there, going up to 655 bps for participants who use the contribution recommendation and 785 bps for participants who also accept the retirement and Social Security claiming age recommendations.

Target-Date Funds or Advisor Managed Accounts. We say both.

Plan sponsors often ask whether they should offer target-date funds OR Advisor Managed Accounts. The answer is plan sponsors should consider offering both. Here’s why.

Target-date funds have been the retirement plan solution of choice for thousands of retirement plans for nearly 30 years. They are popular in large part because they are simple and, generally speaking, effective. A target-date fund uses an asset allocation formula that assumes a participant’s retirement year or age and adjusts the allocation model as the participant gets closer to that date. A younger participant may have a riskier allocation while they are in the accumulation phase but as they near retirement, that allocation automatically shifts to a more conservative posture to better preserve what has been saved. Some people call this a “set it and forget it” option, which isn’t a wholly accurate description of TDFs but does capture the essence of the hands-off approach that many participants enjoy.

Younger participants typically have less complicated financial situations, which makes a TDF a great, simple solution for their needs. But as participants age, their situation can become more complex. Kids, mortgages, aging parents, long-term care, insurance, social security, retirement assets outside the plan – there are a lot of factors that can complicate a person’s financial situation. Advisor Managed Accounts are sophisticated enough to better address the complex needs of older participants.

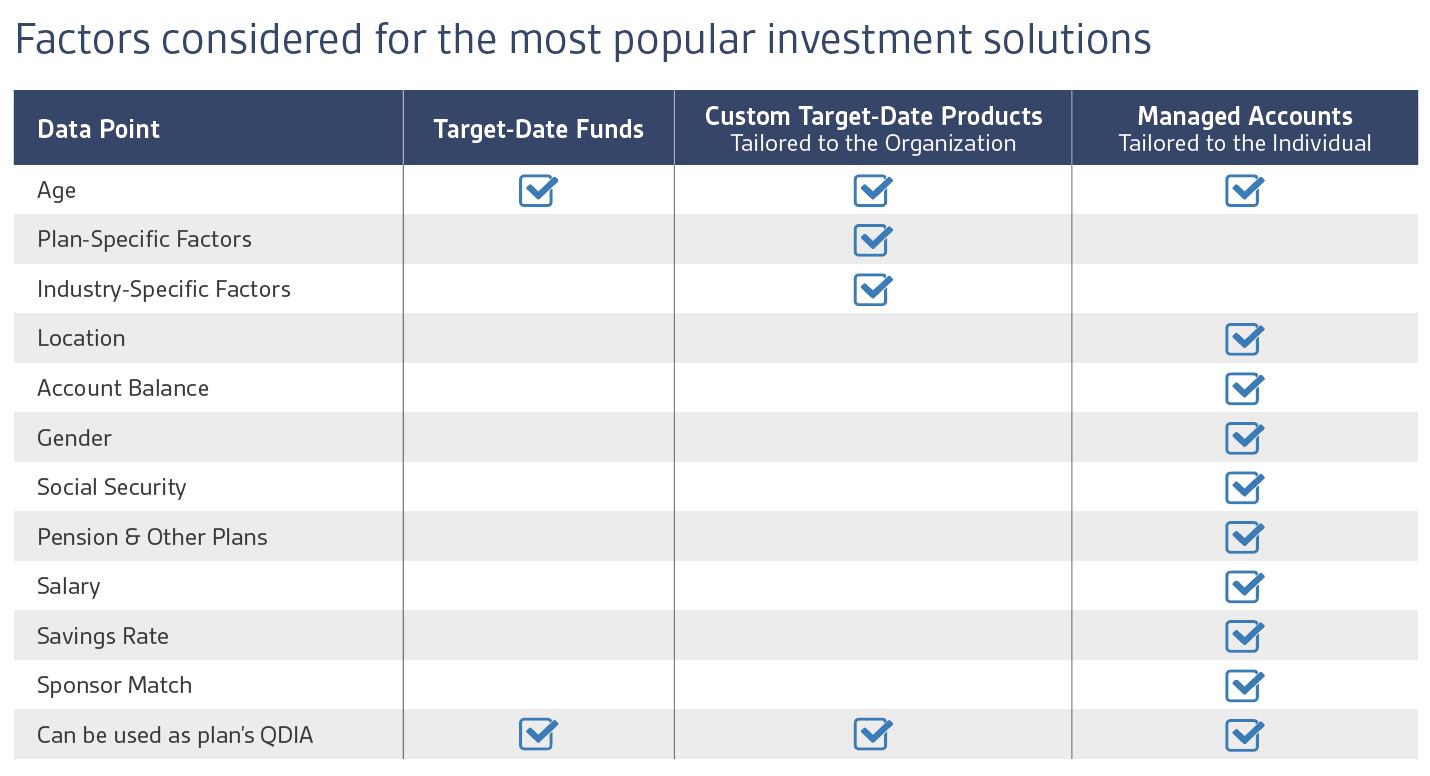

In the graphic below, we show a comparison between the factors considered for TDFs, custom TDFs tailored to the organization and Advisor Managed Accounts.

Target date funds are a simple way to get employees saving for retirement with a well-allocated investment strategy. That strategy is generalized for everyone in the same age cohort and does not provide guidance on their retirement income need, or the savings rate and retirement age to meet that need.

Custom target date portfolios go a step beyond target date funds by tailoring the investment allocations for each age cohort to the demographics and industry of the employer. However, everyone in the same age cohort still gets the same investment strategy, and there still isn’t any guidance on their retirement income need, or the savings rate and retirement age to meet that need.

Advisor Managed Account is a goals-based approach that offers a personalized, well-allocated investment strategy, as well as guidance on the individual’s retirement income need, and the savings rate and retirement age to meet that need.

What are QDIAs and how do Managed Accounts fit in?

A Qualified Default Investment Alternative, or QDIA, is a preselected investment used when funds are contributed to an employee’s 401(k) account, but that employee has not made an investment election. The money is automatically invested in the QDIA, which is selected by the plan fiduciary – usually the business owner or 401(k) plan manager. QDIAs were first introduced in the mid-to-late 90s and since then, 60-70 percent of the country’s more than 660,000 DC plans now automatically enroll participants.

The Pension Protection Act (PPA), signed into law by President George W. Bush in 2006, effectively removed many of the barriers that had previously prevented the adoption of automatic enrollment features in DC plans. The law, and specifically the amendments to the Employee Retirement Income Security Act (ERISA), provides a ‘safe harbor’ for plan fiduciaries investing participant contributions in the plan’s default investments in the absence of participant investment direction, as long as particular requirements detailed by the Department of Labor (DOL) are met. Participants who do not proactively make their own investment election or decline enrollment into their retirement plan will be automatically enrolled using the QDIA and will be properly notified of their enrollment.

For those of you who prefer the SparkNotes version – QDIAs ensure every plan participant, even the ones who do not take the time to make their own investment elections, is automatically contributing to their long-term retirement savings in a way that both benefits the participant with increased savings and protects the plan sponsor from fiduciary liability.

Managed Accounts in a Hybrid QDIA

An emerging trend is combining two popular QDIA options – Target Date Funds and Advisor Managed Accounts – into a Hybrid or Dynamic QDIA. Here’s why this is such an attractive option for both plan participants and sponsors.

Recall earlier in this article how we outlined the benefits of both TDF and Managed Account options, depending on the participant’s financial situation. Early-career participants typically have less complicated situations and therefore, a TDF is a great fit to get them started with a retirement savings plan. Mid-to-late career participants tend to have more complex financial situations and therefore need deeper guidance as they approach their retirement goal. With a Hybrid or Dynamic QDIA, younger participants below a certain age are defaulted into the Target Date Fund corresponding with their age cohort. Once a participant reaches a designated age, they automatically transition into the Advisor Managed Account program, unless they changed their investment selection after being defaulted.

The Hybrid QDIA solution is increasingly selected by advisors and employers particularly because it addresses the need for personalization and flexibility that was previously lacking in the retirement ecosystem. The ability to automatically transition participants from a TDF to a Managed Account creates an efficient and prudent process, offering more benefits for a diverse population of participants and mitigating the fiduciary risk for plan sponsors.

About Qualified Plan Advisors

At Qualified Plan Advisors, we focus on how people save, invest, and manage their money. We work with organizations to design retirement plans that support their overarching corporate and human resource objectives, and identify the retirement plan vendors that best fit those needs, goals and objectives. The cool thing about doing our work within the retirement context is that we get to help a lot of people within three distinct groups: business owners to feel safer and to focus on their employees; HR and benefits professionals to enjoy their jobs more; and hundreds to thousands of employees to live happier, less stressful lives.

We are unapologetic about putting people first. Our passion is in creating solutions that are the right fit for an organization’s people. That’s why we are so excited about offering Advisor Managed Accounts as an opportunity for plan sponsors and the people they serve. Curious how AMAs may fit into your organization’s retirement plan? Let’s talk!