The Bottom Line

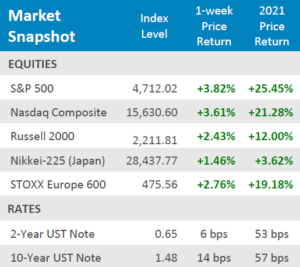

● Domestic and International equities shook off last week’s volatility and posted a strong week of gains.

● Yields rose with equities for the week, the yield on the 2-year jumped up +6bps and the yield on the 10-year rose + 14bps.

● Economic data for the week continued to illustrate that employers are desperately looking for workers with job openings exceeding unemployed Americans by its biggest margin on record, according to the JOLTS, and CPI showed that inflation posted its biggest year over year jump in almost 40 years.

Traders Shake Off Covid Fears

After last week’s bloody sell off, market participants came to terms with the continued spread of the delta variant and shook off their concerns of the new omicron variant. The S&P 500 took off and rose +3.82% for the week and the tech-heavy Nasdaq was right behind it, up +3.61% for the week. Domestic small cap equities were also up for the week, but to a lesser extent at +2.43%, as measured by the Russell 2000. The rally wasn’t limited to just US equities, European equities, as measured by the STOXX Europe 600, rose a robust +2.76% for the week and Japanese equities, as measured by the Nikkei-225, were also up a modest +1.46%for the week. Next week, traders will be keeping an eye on NFIB Small Business Optimism, Industrial Production, and Retail Sales, but the Fed will likely have a monopoly on investors attention on Wednesday after their meeting. With the CPI showing its biggest annual increase in almost 40 years, it is expected that the Fed will give some light on the pace of the winding down of their bond buying program implemented at the start of the pandemic. It’s possible that Fed Chairman Powell may mention the timeline for the first interest rate hike, but most market participants are expecting ambiguous language on that front.

Digits & Did You Knows

FED JOBS – With the resignation of Randal Quarles at the end of 2021 and the expiration of Richard Calrida’s term on 01/31/22, the Fed’s 7-member Board of Governors will have 3 vacancies. President Biden has pledged to “bring new perspectives and new voices” to the Fed board. (source: Federal Reserve, BTN Research).

WAS PRIVATE, NOW PUBLIC – The cost of tuition, fees, room and board at an average public 4-year college for the current 2021-2022 school year is $22,690. The cost of tuition, fees, room and board at an average private 4-year college for the 2000-2001 school year, i.e., 21 years ago, was $22,240.

(source: National Association for the Education of Young Children, BTN Research).

Click here to see the full review.

—

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2021 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.