Quick Takes

● Omicron Impacts International Markets. International equities sold off for the month of December as the omicron variant worked its way through the global population. Domestic equities shook off these concerns and posted a solid month.

● Short-Term Yields Rise, Long-Term Yields Fall. Short duration yields rose by 24bps for the month of December, whereas longer dated yields fell by 4bps for the month as the yield curve steepened. Overall, bonds were roughly flat for the month with High Yield outperforming Investment Grade.

● Dollar Takes A Rollercoaster Ride. The dollar ebbed and flowed for the month of December as investors examined the potential impact that omicron would have on global markets, as well as an increase in the pace of the tapering process of the Federal Reserve.

● Supply chains, Labor Markets, and Inflation. Employment showed continued progress throughout the month, but Labor Markets remain tight with over 110 million open jobs in the US. High frequency data showed that Supply Chain constraints were also easing further, but remain elevated, which further exacerbated inflation.

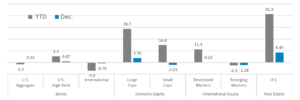

Asset Class Performance

Overall, Risk Assets posted somewhat mixed results for the final month of the year, but US and developed international equities locked in solid year to date returns. Bonds, both domestic and international, finished the year in the red.

Fed Dominates Markets As Traders Shake Off Omicron

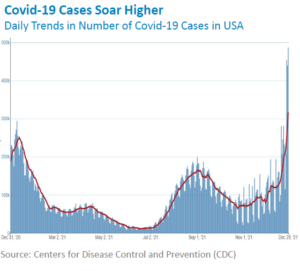

The month of December initially began with traders pricing in a new covid-19 variant’s impact (omicron variant) on markets, but eventually shook off their concerns and turned their attention back to the Federal Reserve.

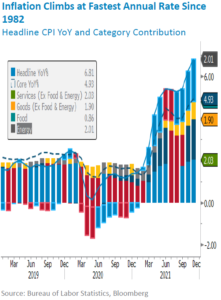

While inflation, as measured by the Consumer Price Index (CPI), came in below expectations for the month of November, the rate of the year over year increase was the largest since 1982. With inflation running hotter than the Federal

Reserve’s anticipation, Chairman Powell announced an increase in the pace of the Fed’s tapering process. The Fed is planning to double its reduction in asset purchases and is now expected to stop adding to its bond portfolio in March of 2022. This increased pace in the tapering process opens the door to a sooner than originally expected increase in interest rates, now expected to occur around the middle of the year in 2022.

The month began with traders in sell mode as they priced in the spread of the omicron variant, but even as case counts reached their highest point in the year, market participants switched into buy mode as the pace of consumer spending increased with holiday shopping. Along with increased consumer spending, consumer sentiment also pushed higher for the month, adding additional confidence to the market’s upward trajectory and pushed equities into new highs during the month. While US markets finished the month below these newly achieved highs, strong year to date gains were solidified as the grind higher resumed. International markets, especially those in emerging economies, did not fair as well as domestic markets due to their lower vaccination rates. Developed markets were slightly positive for the month and locked in a double digit return for the year, while Emerging markets were in the red both for the month and the year.

The month began with traders in sell mode as they priced in the spread of the omicron variant, but even as case counts reached their highest point in the year, market participants switched into buy mode as the pace of consumer spending increased with holiday shopping. Along with increased consumer spending, consumer sentiment also pushed higher for the month, adding additional confidence to the market’s upward trajectory and pushed equities into new highs during the month. While US markets finished the month below these newly achieved highs, strong year to date gains were solidified as the grind higher resumed. International markets, especially those in emerging economies, did not fair as well as domestic markets due to their lower vaccination rates. Developed markets were slightly positive for the month and locked in a double digit return for the year, while Emerging markets were in the red both for the month and the year.

Bottom Line: The narrative for the month of December began with fears over the spread of the omicron variant, but eventually shifted to focus on Fed speak as Chairman Powell announced an increase in the pace of the tapering process, which will likely lead to a rate hike sooner than originally anticipated. Market participants took this news in stride and pushed equities to record levels.

Click here to see the full review.

—

©2022 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.