Quick Takes

- Risk Assets Stumble Into Year End. Most risk assets declined for the final month of the year on the back of hawkish Fed speak, which locked in an abysmal double-digit decline for almost every asset class on the year to date returns for 2022.

- Fed Moderates Rate Hike. While the Fed still increased the upper bound of interest rates during their December meeting, the increase was 50bps as compared to the previous hikes of 75bps. Despite this moderation in hike, the language during the press conference and interviews afterwards was decisively hawkish.

- Greenback Retreats for December. The dollar ebbed and flowed against other major currencies for the month of December but overall retreated from its high for the month, which was achieved during the first half of the month.

- GDP, Labor Markets, and Inflation. GDP for the third quarter of the year came in hotter than expected but most inflation metrics came in softer than expected despite labor markets maintaining their tightness. It appears that the Fed’s tightening of financial conditions has started to affect the US economy as intended but the concerns surrounding a hard landing, i.e., a recession, is still top of mind

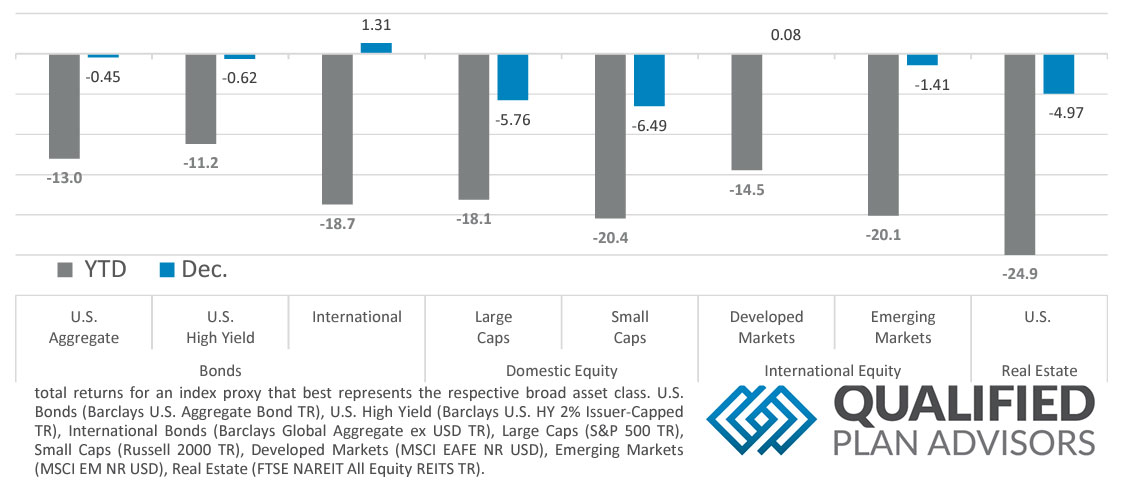

Asset Class Performance

Most major asset classes declined for the month of December, except for Developed International Equities and International Bonds posting a modestly positive month, which locked in double-digit declines for most major asset classes. With 2022 ending, market participants have already shifted their focus to the new year.

Markets & Macroeconomics

Much to market participants’ surprise, US GDP for the third quarter of 2022 come in above consensus expectations of +2.9%, landing at +3.2%. Additionally, Personal consumption, a component in GDP calculations, was revised quite a bit higher from the first reading estimate of +1.7% to +2.3%. This revision in consumer spending was mostly due to an upward revision on service spending. Despite the Fed’s tightening actions during the year of 2022, consumers have not only weathered the storm relatively well but have also maintained a solid level of spending. This has helped to prop up the US Economy overall throughout the year. While consumers spending more on services may lead to some concerns on its impact to overall inflation levels, overall Personal Spending levels for November came in below expectations of +0.2%, at +0.1% on the month over month metric. Digging into the underlying components of Personal Spending, while service spending has remained robust, goods spending is starting to show some downward pressure. This is further illustrated with manufactures reporting contracting new orders over the past several months and thus has led to manufactures ordering less inventory/raw materials. Another area of soften demand as a result of the Fed’s tightening actions has been the housing market. With mortgage rates skyrocketing over the year, this has led to a slackening housing market over the past several months. Putting everything together, it appears that the Fed is on the right track to successfully slow the economy, which should in turn help to exert downward pressure on inflation levels. As we have mentioned in previous editions, the Fed is attempting to thread the needle by slowing the economy, with the main goal of stifling runaway inflation, while keeping overall economic growth positive. The biggest obstacle for the Fed to overcome will be taking their foot off the gas of their tightening at the correct point in time to ensure that their policy does not become overly restrictive to businesses and consumers alike and send the US economy into a recession.

Bottom Line: GDP for the third quarter came in hotter than expected on the back of robust consumer spending, mostly attributable to consumer spending on services. Goods spending, manufacturing production and new orders have also been moderating as the Fed’s tighter monetary policy has worked its way through the US economy, and this has begun to affect the housing market as well. It remains to be seen if the Fed will be able to thread the needle of taming inflation without sending the economy into a recession in the coming months.

©2022 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.