The Friday after Labor Day is National 401(k) Day which means now is the perfect time to revisit your retirement goals and make sure you’re taking full advantage of your retirement plan. We all dream of a life of leisure during our golden, retirement years. National 401(k) Day, celebrated every year on the Friday after Labor Day, prompts us to check in on our nest egg.

CELEBRATE YOUR 401(K) BY ACTING TODAY!

If you are not enrolled in your company retirement plan, take the time to enroll today…

Consider increasing your retirement plan contributions if you have the capability, especially if you recently got a raise or bonus!

If your employer offers a matching contribution, try to contribute at least the minimum amount needed to get the full benefit.

THREE ADVANTAGES OF CONTRIBUTING REGULARLY TO YOUR PLAN:

1. CONVENIENCE

Once you have determined how much of your pay you want to contribute toward retirement, those contributions are automatically deducted from your paycheck. Super easy!

2. COMPOUNDING

Compounding can turn a small investment into a large sum, but time is of the essence. The earlier you start saving, the more compounding can work its magic.

3. TAX BENEFITS

When you utilize your employer’s retirement plan, you can reduce your federal income taxes. If you make contributions on a pretax basis, you won’t need to pay current income taxes on the money that goes into your account. It will grow and compound without taxes until you withdraw them at retirement.

Take the 1% Challenge

Often, it’s the little things in life that can make the biggest difference. That’s true when it comes to saving for retirement. Increasing your savings by just 1% now could mean a lot in retirement.

A 1% increase may not seem like much, and that’s precisely the point. While you won’t feel a major sting when you get your next paycheck, your investments will benefit over the long run.

Those small jumps by just 1% or 2% over a 20-year or 30-year career can really make a big difference in the end.

While one percent is a small percentage of your annual earnings today, after 20 or 30 years it can make a big difference in your account balance when you retire. That’s because the longer you give your money a chance to grow, the better. And it works no matter how old you are—or how far off retirement is.

Let’s look at some examples.

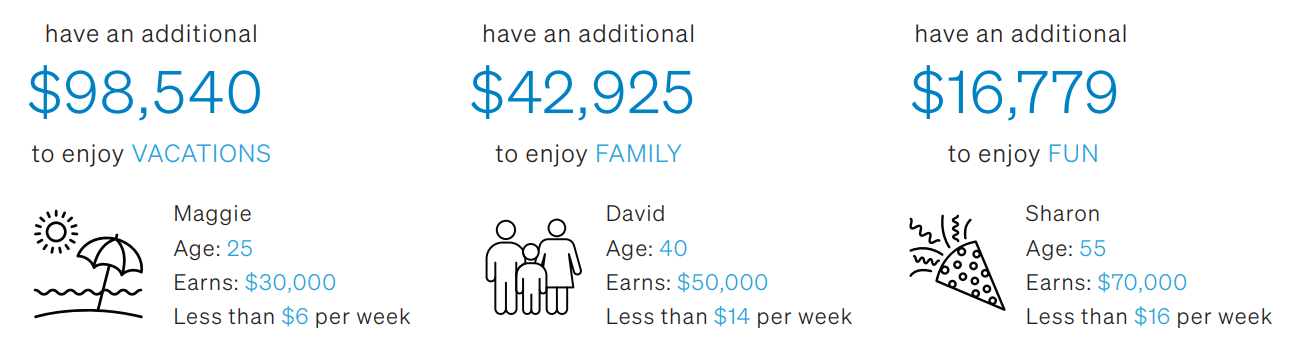

Increase your contribution by 1% and by retirement you could*…

As you can see in our examples—small weekly amounts like $6, $10, and $14 can make a noticeable difference in your savings. So how do you find the money? Work with your financial representative to identify places in your spending that may be easy to cut. Even bringing your lunch or using coupons could save you $14 or more. And the beauty of 401(k) contributions is that they come right out of your paycheck, so you may not even miss the spending money.

If a one-time bump-up isn’t ideal now consider increasing your contribution at your next pay raise. If you usually get a raise each year, you may be able to time the increase to happen when you get a bump in pay so you won’t feel the impact in your paycheck.

Not sure where to start? We’re here for you! Contact us to kickoff a discussion around your own contributions.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

*Approximation based on a 1% increase in contribution rate. Continued employment from current age to retirement age, 67. We assume you are exactly your current age (in whole number of years) and will retire on your birthday at your retirement age. Number of years of savings equals retirement age minus current age. Investment growth rate is assumed to be 6%. Hypothetical salary growth rate is assumed to be 4% (2.5% inflation + 1.5% real salary growth rate). This assumes no loans or withdrawals are taken throughout the current age to retirement age.

Your own plan account may earn more or less than this example and income taxes will be due when you withdraw from your account. Investing in this manner does not ensure a profit or guarantee against a loss in declining markets.

Investing involves risk, including the risk of loss.