Quick Takes

● Risk assets hit a speed bump. September ended deeply in the red for risk assets as global growth concerns began to weigh on the market. September is the first negative month since January and the worst month since March of 2020.

● Duration erodes growth. The yield on the US 10-year Treasury rose for the sixth week in a row as the Fed produced hawkish language after its Jackson Hole Symposium. As yields continued to climb, growth equities and longer duration bonds fell, but high yield and credit managed to tread water.

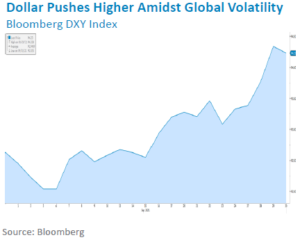

● Support for the Dollar. With the Fed clearly alluding to tighter monetary policy “soon”, probably by year end, the dollar climbed +1.73% for the month. Projections for interest rate hikes were pushed forward into 2022 and should offer support for a stronger greenback.

● Supply chokes demand. Supply chain bottlenecks have stifled additional growth. Regional outbreaks, and subsequent shutdowns, due to the delta variant have upended manufacturing and global logistics. Additionally, continued strife within the labor market are further impacting “return to normal”.

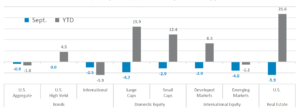

Asset Class Performance

For the first time since January, almost all risk assets posted a loss for the month of September. High Yield Bonds were the winners for the month by ending flat. Supply-chain shortages and slowing growth caused the sell-off.

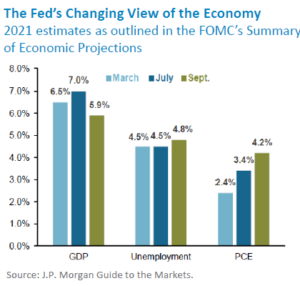

Stocks retreat from record highs on continuing growth concerns

September, historically the worst month for stocks, held up to its reputation and ended with most major asset classes in the red. The sell-off was a result of concerns over slowing economic growth and the effect that fast-approaching tighter monetary policy might have on subsequent economic growth. After a slew of public speaking events from Federal Reserve officials, growth estimates for the year began to moderate, with GDP now estimated to be +5.9% versus the higher estimate of +7.0% back in July. Fed officials also see unemployment being higher than previously estimated as well as higher inflation for the year. After the Fed’s September meeting, the first interest rate hike was moved up from the beginning of 2023 to 2022. The Fed’s more hawkish tone has caused volatility amongst yields on interest bearing securities and on the final Tuesday of the month, the yield on the 10-year Treasury note reached 1.567%, a level not seen since June. This spooked traders as they fled from higher duration equities, i.e., growth style equities, and longer maturing bonds. Small Cap equities offered some protection from the drawdown, down -2.9% versus Large Cap equities being down -4.7% for the month. After being on a seemingly unstoppable tear for most of the year, Real Estate finally had its day of reckoning and sold off -5.9% for the month. International bonds and equities also offered some form of protection, down -2.5% and -2.9% respectively.

With global investors looking to derisk, the dollar became a haven for many and rose +1.73% for the month, as measured by Bloomberg’s DXY Index. This also contributed to International asset’s falling for the month. Emerging markets were hit hard during the month as well. Concerns regarding a possible contagion effect from China’s largest property developer, Evergrande, nearing default. Headlines began to emerge equating Evergrande’s probable default to U.S.’s Lehman Brother’s default back in the Great Financial Crisis. Ultimately, it appears that a mass systemic failure of the financial system will be unlikely, however the effects will not be nothing. China’s GDP will likely take a hit and over economies affected as a result.

With the Fed looking to tighten monetary policy by year end, the backdrop for a stronger dollar seems supportive, which will likely weigh on International and Emerging markets.

With the Fed looking to tighten monetary policy by year end, the backdrop for a stronger dollar seems supportive, which will likely weigh on International and Emerging markets.

Bottom Line: September was the worst month for markets since the beginning of the pandemic. Significant risks to the market have emerged, including slowing economic growth and possible monetary tightening during this slowing growth period, high inflation that is showing signs of being stickier rather than transitory, supply-chain and logistical bottlenecks, and laborers not returning to the workforce. While this recent bout of volatility has not been seen since March of 2020, historically speaking, September and October are typically the most volatile months of the year.

Click here to see the full review.

—

©2021 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a

Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management

(“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2021 Prime Capital Investment Advisors, 6201 College Blvd., 7th Floor, Overland Park, KS 66211.