The Bottom Line

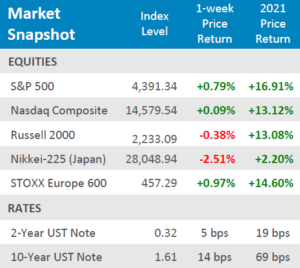

● Equities were able to claw back some of the losses from the previous weeks, but Small Caps and Japanese equities still fell further.

● The 10-Year yield steadily climbed up for the week, up + 14bps and took the 2-Year yield with it, up +5bps for the week.

● Economic news was largely mixed for the week, some metrics for employment started to show some much-needed signs of relief, while others disappointed. Service spending seem to be expanding, but mortgage applications stumbled lower for the week.

S&P Rises as Unemployment Falls

After last week’s gruesome selloff, most equity indices parred some of their previous losses after Congress kicked the can on the U.S. government’s debt ceiling to mid-December. The S&P 500 was up a modest +0.79% and the Nasdaq clung to positive territory after a miss on Unemployment numbers, up marginally at +0.09% for the week. European equities had a strong week, up +0.97% for the week, as the ECB announced they were looking for new ways to implement quantitative easing for when the next crisis strikes their economy. Small Cap equities were troubled for the week as yields steadily climbed upward, the Russell 2000 was down -0.38% for the week. Japanese equities had a dismal start to the week, by Wednesday the Nikkei-225 was down almost -4.5% but reclaimed some ground on Thursday and Friday and finished the week down -2.51%. A curious case unraveled for the week with employment data, some metrics in the middle of the week suggested that employment was finally starting to gain some upward momentum, but the official government numbers came in well below expectations. All eyes are now shifting back to the Fed and when they might begin to taper assets.

Digits & Did You Knows

STOCKS & WHITE HOUSE – From 1936-2020, the S&P 500 has averaged +6.7% per year (total return) during the 1st year of a 4-year presidential term, +8.7% per year during the 2nd year,+18.5% per year during the 3rd year, and +9.8% per year during the 4th year. 2022 will be year # 2 of a 1st-term Biden administration. (source: BTN Research).

SKILLS NEEDED – 75% of executives surveyed in December 2020 anticipate increased spending in “automation and technology” through December 2024. (source: McKinsey Global Economic Conditions Survey, BTN Research).

DID NOT GO TO COLLEGE – 64% of American adults at least age 25 don’t have a bachelor’s degree from college. (source: Census Bureau, BTN Research).

Click here to see the full review.

—

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2021 Prime Capital Investment Advisors, 6201 College Blvd., 7th Floor, Overland Park, KS 66211.