The Bottom Line

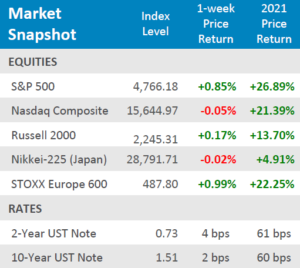

● Despite low volume during the final week of the year, global equities were mostly in the green for the week, solidifying robust returns for the year of 2021.

● Yields gently climbed upward for the week, the yield on the 2-year Treasury Note was up +4bps and the yield on the 10-year Treasury Note was up +2bps .

● Economic data for the final week of the year was on the lighter side, but housing related data releases showed that despite a slump in Pending Home Sales, real estate prices continue their grind higher. Regional manufacturing data illustrated some booms and some busts for the month of December.

Equities Off Highs, But Not By Much

While not quite finishing the week at all time highs, the S&P 500 still managed to post a respectable gain of +0.85% for the week, which locked in a staggering YTD gain of +26.89%. Small Cap equities, as measured by the Russell 2000, weren’t quite as exciting, only up +0.17% for the week and +13.70%for the year. The tech-heavy Nasdaq ended the week in the red, down slightly by -0.05%, but locked in a robust YTD return of +21.39%. Just ahead of the Nasdaq for the week, Japanese equities, as measured by the Nikkei-225, were also down slightly at -0.02% for the week and posted a more modest YTD return, up +4.91% for 2021. Japanese markets were closed on the final day of the year for the New Year’s holiday. European equities, as measured by the STOXX Europe 600, had a nice close to year, up +0.99% for the last week of 2021 and cemented a solid return of +22.25% for the year. Looking ahead to the first week of the New Year, market participants will be focusing on employment data releases with ADP employment numbers scheduled for Wednesday and the official government numbers scheduled for Friday. Additionally, manufacturing data and trade related releases are scheduled for Wednesday and Thursday.

Digits & Did You Knows

AT THE HIGH END – A year ago (12/21/20), Barron’s published the year-end 2021 forecast for the closing yield on the 10-year Treasury note made by 10 Wall Street strategists. The 10 predications ranged from a low of 1.00% to a high of 1.50%. The 10-year note’s actual yield close on 12/31/20 was 0.913%. The yield on the 10-year Treasury note closed at 1.51% on 12/31/2021. (source: Barron’s, BTN Research).

HELPING THE SMALL MARKET TEAMS – 48% of the local revenue of every MLB team, i.e., local TV contracts, ticket gate receipts, concessions, and parking revenue, goes into a “revenue sharing pool” that is split equally among all 30 MLB teams. (source: MLB, BTN Research).

Click here to see the full review.

—

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2021 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.