The Bottom Line

● Global equities continued their sell off for the week as the conflict between Russia and Ukraine raged on.

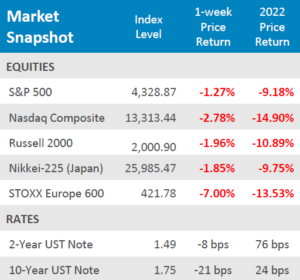

● Bond yields fell for the week as market participants moved further into risk off mode. The yield on the 2-Year US Treasury Note by -8bps and the yield on the 10-Year dropped -22bps.

● Economic data releases for the week were jampacked with employment data, all of which came in above expectations and illustrated that despite geopolitical tensions, businesses are still looking for workers. Additional releases relating to manufacturing showed some signs of production moderating.

Russia – Ukraine Conflict Intensifies

Despite the US posting robust labor market data readings, market participants completely ignored the positive news, instead focusing on the Russia-Ukraine conflict. European equities, as measured by the STOXX Europe 600, took most of the selling pressure for the week, falling -7.00% as market participants priced in the impact the conflict might have on European markets. Japanese equities, as measured by the Nikkei-225, were also in the red for the week, falling -1.85% on the week. Domestic equities weren’t spared from the selling pressure either as most major US indices ended the week in the red, deepening their year-to-date losses. The S&P 500 fell -1.27% for the week, now down -9.18% for the year. The tech-heavy Nasdaq Composite fell -2.78% for the week and is down an astounding -14.90% for the year so far. Small Cap equities, as measured by the Russell 2000 fell by -1.96% for the week and are down -10.89% for the year. While the Russia-Ukraine conflict has been impacting global markets, it does not appear to have materially affected the Fed’s timeline for raising interest rates later this month. Fed Chairman Jerome Powell all but guaranteed a liftoff in the Fed Funds Rate during his testimony to congress earlier in the week.

Digits & Did You Knows

SMALLER HOMES – The average size of a single-family home built in the US in 2020 was 2,480 square feet, the 5th consecutive year that the national average size has declined. (source: Census Bureau, BTN Research).

HIGHEST NUMBER EVER – Mortgage debt ($10.93 trillion) and auto loan debt ($1.46 trillion) reached all-time record highs as of 12/31/2021, while student loan debt ($1.58 trillion) at the end of 2021 was just $8 billion below its all-time high. (source: Federal Reserve Bank of New York, BTN Research).

Click here to see the full review.

Source: Bloomberg. Asset-class performance is presented by using market returns from an exchange-traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High-Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 31% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.