The Bottom Line

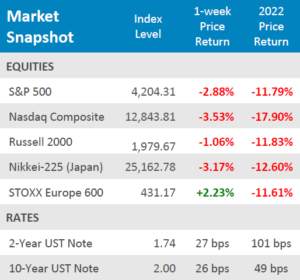

● European equities were able to recover some losses for the week, but the rest of global equities were largely in the red as the conflict between Russia and Ukraine raged on.

● Bond yields steadily rose throughout the week, the yield on the 2-year UST Note was up 27bps and the yield on the 10-year rose by 26bps.

● Economic data releases for the week showed that inflation continues to rise at a breakneck pace and that open jobs are consistently hovering near record highs with the tight labor market. Looking ahead, market participants will be eagerly awaiting next week’s FOMC interest rate decision.

Russia – Ukraine Conflict Remains Top of Mind

The conflict between Russia and Ukraine continued to steal traders’ attention as market participants estimated the longer-term effects on the global economy due to increased input costs and increased geopolitical tensions. There was a small reprieve from the selling pressure in the middle of the week as hints of possible negotiations surfaced, but the conflict appears to be far from over. European equities, as measured by the STOXX Europe 600, were able to recover some of their losses this week, rising +2.23% for the week. Japanese equities, as measured by the Nikkei-225 fell by an additional -3.17% for the week. Domestic equities were broadly in the red for the week. The S&P 500 fell by -2.88% for the week. Small cap equities, as measured by the Russell 2000, were down -1.06% on the week. The tech-heavy Nasdaq Composite continued its downward spiral by falling -3.53% for the week. With the FOMC’s rate decision meeting happening next Wednesday, market participants will be eagerly awaiting to see if Powell stays true to his word and raises interest rates by 25bps or less likely 50bps.

Digits & Did You Knows

DEFAULT – Russia announced on 8/17/1998 that it was unable to service its government debt (both short-term and long-term) with a face value of $45 billion, causing ripples in the global economy. The S&P 500 fell 11.6% (total return) within 2 weeks before recovering. From 8/17/1998-

2/17/1999 (6 months), the S&P 500 was up +13.8% (total return), continuing a bull run that would end on 3/24/2000. (source: BTN Research).

BLUE BLOODS – 0n 2/26/2022, the top 6 men’s teams in AP basketball poll – Gonzaga, Arizona, Auburn, Purdue, Kansas and Kentucky – all lost games on the same day for the first time in history. (source: ESPN, BTN Research).

Click here to see the full review.

Source: Bloomberg. Asset-class performance is presented by using market returns from an exchange-traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High-Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 31% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.