Quick Takes

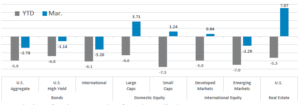

- Equities Cautiously Advance. Domestic and International Developed equities posted a month in the green but remain in the red for the year thus far. Bonds and Emerging Markets continued their year-to-date rut.

- Interest Rate Liftoff. As expected, the Federal Reserve conducted their first interest rate hike of 25bps during their March meeting. The yield on the 2- Year UST Note jumped 90bps and the yield on the10-Year UST Note rose 51bps. The Fed is expected to continue to increase rates for the remainder of 2022.

- Greenback Has A Bumpy Month. The dollar went for a rollercoaster ride for the month of March, rising to a recent high of 99.293 at the beginning of the month, but finally settled at 98.312 by the end of the month.

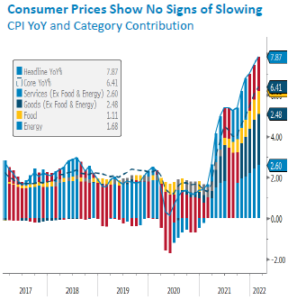

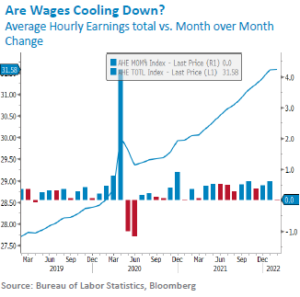

- Supply chains, Labor Markets, and Inflation. Inflation showed no signs of rolling over with the Consumer Price Index (CPI) rising +7.9% on a year-over-year basis and the Producer Price Index (PPI) screamed ahead at +10% for the same period. Labor markets continued along the same theme as before-too many jobs, not enough workers, indicating that tightness will likely be here to stay for a while.

Asset Class Performance

After a dismal start to the year, equities were able to show some signs of life, but bonds, both domestic and international were still negative for the month, deepening their YTD selloff. While equities mostly posted a positive month, YTD returns are also still in the red.

Inflation Carries On at a Red-Hot Pace, but Wage Growth Flattens

Regardless of the preferred inflation metric, from CPI to PCE to PPI, most measures told the same story-inflation is continuing to rise into the new year. While the Russia-Ukraine conflict’s direct impact on the US should be minimal, it will likely affect global supply chains, which have continued to be strained as the world “learns to live with Covid-19”. This additional pressure on supply

chains will likely bleed over into inflation as raw materials for producers and finished goods for consumers will remain scarce and at elevated price levels. Sustained levels of increasing inflation will put additional pressure on the Federal Reserve to take more decisive action in getting inflation under control via interest rate hikes and quantitative tightening. The Fed was originally delaying interest rate hikes due to the labor market’s start and stop action due to the spread of various Covid-19 variants throughout last year. Now, it appears that the US economy, and many others, are finding ways to “live with Covid” and the labor market remains very tight with the unemployment rate below pre-pandemic levels and a plethora of open jobs with the Job Openings Labor Turnover Survey (JOLTS) coming in at 11.26 million at the beginning of the month.

Participation in the labor market remains below pandemic levels, insinuating that there is still recovery to be had. It’s possible that if rampant inflation continues, sidelined workers may return to the labor market as savings dwindle due to increased price levels and increased levels of compensation as employers compete for workers. While employers are desperate to find help, they may have reached their limit on compensation, as illustrated in the chart above, wage growth has begun to flatline for this year. Inflation isn’t just affecting consumers, employers are also feeling the pressure, so the flattening wage growth may be due to employers attempting to gain greater control on input prices.

Bottom Line: Economic data releases for the month of March showed that the trending topics of rising inflation and tight labor markets showed little signs of abating. The Federal Reserve initiated interest rate liftoff with a 25bps hike in the Fed Funds Rate and the readings surrounding hot inflation and robust employment, despite lower participation and flatlining wage growth, leaves little room for the Fed to not continue to hike interest rates throughout the remainder of the year and opens the door to a more aggressive policy, possibly even one or two 50bps hike in the coming months.

Click here to see the full review.

©2022 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.