Quick Takes

- Scary October for Risk Assets. Risk assets were spooked into negative territory for the month of October with almost all asset classes in the red for the month.

- Inflation Stays Steady. Inflation, as measured by the Consumer Price Index (“CPI”), came in slightly above market estimates of +3.6%, landing at +3.7% for the month of September, which was in line with the previous reading. While slightly above expectations, market participants mostly shook off the surprise and paid greater attention to Fed speak for the month of October.

- Greenback Volatility. The dollar had a rollercoaster ride for the month of October but ended the month off its low point. Regardless of the month end resiliency, the dollar ended down for the month versus other major currencies.

- Economic Production and Consumers. The first reading of third quarter economic production came in stronger than expected, landing at +4.9% versus expectations of +4.5% and well above second quarter figures of +2.1%. Consumer Spending drove a lot of the surprise in third quarter GDP numbers but questions surrounding the sustainability of the spending levels are top of mind for market participants.

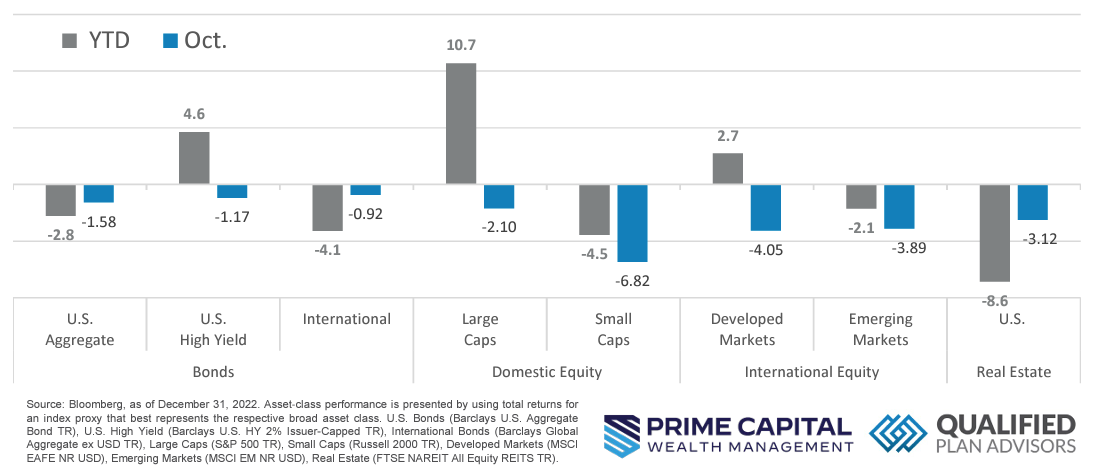

Asset Class Performance

Risk Assets struggled for the month of October with almost all asset classes posting a negative monthly return. Small Caps led the way down as market participants went risk off and International Bonds gave some downside protection but were still down almost a percent for the month.

Markets & Macroeconomics

There has been no shortage of warning signs going off in financial and economic data readings for the year, consumers seem to be completely unaware. The initial reading for third quarter Personal Consumption Expenditures came in red hot at +4.0%. While some of this reading was due to temporary major events at the end of the summer like the Oppenheimer movie and Taylor Swift and Beyonce’s concert tours, it appears that consumers were also buying physical goods as well as services. Both metrics were up from the second quarter’s reading, with Services Spending increasing at a +3.6% and Goods Spending at +4.8%. With many market participants aware that these figures may have been skewed by the temporary spending on the major events at the end of the summer, market participants largely shook off the slightly higher than expected reading of inflation metrics for the month of September. On a similar note, with GDP coming in robustly for the third quarter at +4.9% on the initial reading, market participants likely chalked this up to the temporary spending on the aforementioned major events, back to school shopping, or last-minute end of summer vacations. With all the positive news seeming to be ignored by market participants, Fed Speak seemed to take center stage for the month of October. The general consensus from Fed members seemed to indicate that a pause in rate hikes will occur for the November meeting but left the door open for one more hike for 2023 or possibly even into the new year. Many members made comments stating that progress seems to be made after the rapid tightening in financial conditions, but the Fed is hesitant to declare victory at this point. This rhetoric sent bond yields soaring for the latter half of the month across the yield curve as evidenced by the yield on the Generic US Treasury 10-year coming dangerously close to 5.0% level.

Bottom Line: Market participants largely shook off some of the positive economic readings for the month of October like Consumer Spending remaining strong across both goods and services as well as GDP coming in at a very robust pace for the third quarter, paying more attention to the Fed speak throughout the month and its effect on the bond market. With yields showing upward momentum across the curve at the end of the month on the back of Fed members recent rhetoric, many market participants became concerned with the impact that high borrowing costs may have on future economic growth prospects, and this seems to be the main catalyst for risk assets posting a negative month for October.

©2023 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

© 2023 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.