Quick Takes

- Risk Assets Snap Losing Streak. Market participants went full risk on for November with almost all major asset classes healthily in the green for the month.

- Inflation Declines. Inflation, as measured by the Consumer Price Index (“CPI”), came in slightly below market estimates of +3.3%, landing at +3.2% for October. Similarly, the Fed’s preferred metric, PCE Deflator, came in softer than expectations of +3.1%, coming in for October at +3.0%. The softening of inflation metrics led to bond yields, especially longer duration, to tumble in the month of November.

- Greenback Goes Down. The dollar spent the majority of the month in a steady state of decline versus other major currencies as domestic bond yields fell across the yield curve.

- Economic Production and Employment. The first revision of third-quarter economic production came in stronger than expected, landing at +5.2% versus expectations of +5.0% and well above second-quarter figures of +2.1%. High-frequency employment data readings continued to suggest that the labor markets are showing more signs of softening. Additionally, Personal Income figures for October landed in line with market expectations of +0.2%.

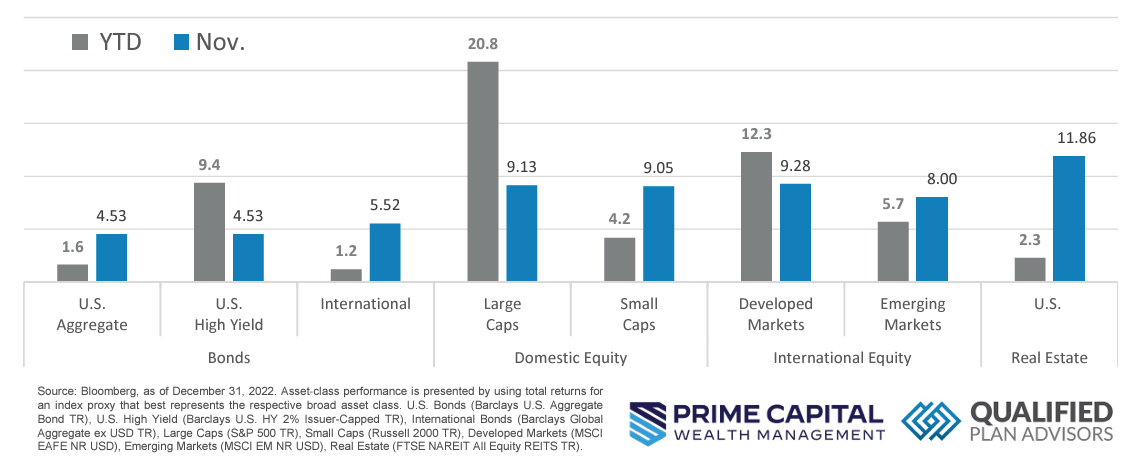

Asset Class Performance

Risk Assets took off for November with almost all asset classes posting strong returns for the month. Domestic Real Estate equities led the pack, posting an +11.86% return for the month. International equities modestly outperformed their Domestic equity peers, while Emerging Markets were somewhat left behind in the rally, but still healthy in the green for November.

Markets & Macroeconomics

The consumer has been the hero for the year so far, with their robust spending habits keeping the US economy afloat on the back of the Fed’s monetary tightening campaign to subdue inflation. After September’s gangbuster reading, however, the month of October came in at a much more modest level. While consumers have been propping up the US economy, this could be a “bad news is good news” scenario. Decelerating consumer demand paired with the current restrictive levels of monetary policy, could be enough of a push to get inflation levels back to the Fed’s long-term target rate of +2.0%. Adding fuel to this fire, the Core Personal Consumption Expenditures (“PCE”) price index landed at +3.5% on the year-over-year metric, showing that the Fed is making progress at taming inflation. With inflation metrics and spending metrics showing signs of softening, this was likely the catalyst for bond yields tumbling in November, which led to a rally in not only the bond market but equity markets as well. Market participants were originally pricing in rate cuts to begin in late 2024 or early 2025, now that timeline has been moved up to the second quarter of next year. While the optimism for risk assets is encouraging, it’s possible that consumers shored up their spending in anticipation of the upcoming holiday season, so we may see a temporary bump in spending levels through the end of the year. While the possibility of a sooner than originally anticipated slackening of monetary policy is leading to exuberance in risk assets, it might be premature as there is no guarantee that a softlanding scenario will play out. While softer consumer spending bodes well on the inflation front, it does not bode well for economic production with consumer spending being one of the only areas that is keeping domestic GDP in the green so far. It remains to be seen if the Fed will be able to thread the needle and prevent the US from entering a recessionary period while getting inflation back down to its long-term targeted rate.

Bottom Line: Market participants cheered positive economic data readings of continued softening in inflation metrics as well as softening consumer spending. This led market participants to price in a slackening of monetary policy earlier than originally anticipated, which fueled a healthy rally in risk assets for the month of November. While the news in the month of November supported the narrative that the Fed is well on its way to taming rampant inflation, the threat of a hard landing still looms over the US economy, leading some market participants to preach caution over optimism with many believing that risk asset valuations are reaching overbought levels in some areas of the market.

©2023 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

© 2023 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.