The Bottom Line

● U.S. Equities faltered after inflation came in above expectations and jobless claims broke the recent trend coming in above expectations as well.

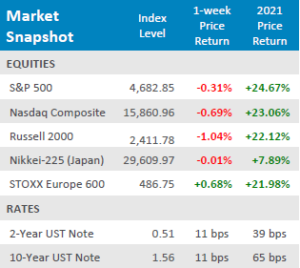

● Yields rose as equities fell, both the 10-year yield and the

2- year yield rose +11bps.

● Economic data for the week was on the lighter side with the Veteran Day’s holiday falling during the week but was impactful with markets. Inflation, as measured by the CPI, surprised to the downside, coming in above expectations. Jobless Claims and JOLTS showed that despite last week’s positive reading, labor markets are still showing signs of strain.

Inflation Rears Its Ugly Head…Again

After last week’s push higher day after day, nothing seemed to be able to derail the market’s rise until first, jobless claims broke the recent trend and disappointed to the downside, then inflation, as measured by the Consumer Price Index (CPI), came in hotter than expected on Wednesday. By Friday, U.S. Equity indices were able to recover some of their losses, but still ended the week in the red. The S&P 500 was down -0.31% for the week, after it halted an 8-day win streak on Tuesday. The Nasdaq faired worse as it took the brunt of the sell off in the middle of week, but quickly reclaimed losses later in the week, however it wasn’t enough to boost it back into positive territory, down -0.69% for the week. Small Cap equities were hit the hardest for the week, the Russell 2000 was down -1.04%. International equities were able to fair the week better than domestic equities. Japanese equities, as measured by the Nikkei-225 was down slightly for the week at -0.01% and European equities were able to finish the week in the green, up +0.68%. In the coming week, market participants will be paying close attention to retail sales and imports for any signs of supply chain disruptions worsening or improving.

Digits & Did You Knows

PAYING A LOT MORE – The average price of a gallon of gasoline has gone up by more than $1 during calendar year 2021, rising from $2.253 a gallon as of 12/31/20 to $3.421 a gallon as of Friday 11/05/21. The last calendar year that experienced gas prices rising by at least $1 was 2009 (source: AAA, BTN Research).

PREPARE TO START AGAIN – The 42.9 million Americas with federal student loans have benefited from a freeze on student loan payments that was implemented on 03/27/20. The freeze, which will continue until 02/01/22, includes a suspension of loan payments, a 0% interest rate during the freeze, and a deferral of collections on defaulted loans.

(source: Department of Education, BTN Research).

Click here to see the full review.

—

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2021 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.