The Bottom Line

● US Markets lost the ground they gained last week after inflation came in hotter expected and tensions between Russia and Ukraine escalated.

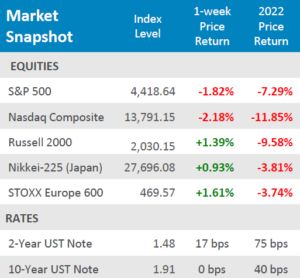

● Yields spent most of the week in a general uptrend but fell modestly as investors de-risked on Friday. The yield on the 10-year ended flat and the 2-year yield was up + 17bps.

● Economic data for the week was on the lighter side, but very impactful with the hottest inflation release since 1982 and Consumer Sentiment set a fresh decade low,

Geopolitical Tensions and Inflation Spook Markets

The first half of the week was bright with potential as corporate earnings painted a robust picture for the fourth quarter of last year, but this optimism was eventually wiped out when a National Security Adviser speculated that Russia could insight conflict with Ukraine as early as next week. Both US and International Markets sold off late into Friday’s trading session. European equities, as measured by the STOXX Europe 600, were able to cling to a modest weekly gain of +1.61%. Japanese markets, as measured by the Nikkei-225, also held a respectable gain of +0.93% for the week but were closed on Friday for a holiday. Domestic markets didn’t fair as well, the S&P 500 lost -1.82% for the week and the tech-heavy Nasdaq Composite lost -2.18% for the week. Small Cap equities, as measured by the Russell 2000, were able to hold onto a weekly gain of +1.39% but were in the red for both Thursday and Friday’s trading sessions. Market participants will be keeping a close eye on the situation unfolding between Russia and Ukraine, as well as Fed member commentary surrounding the red-hot CPI data release.

Digits & Did You Knows

HOUSING COSTS GO UP – The cost to rent housing nationwide increased by an average of +14.1% in 2021. The average monthly mortgage payment paid by a new US homeowner who put 5% down at purchase increased by 21.6% in 2021. (source: Redfin, BTN Research).

TRUSTING THE FED – In spite of inflation (measured by the Consumer Price Index) that was up +7.0% in 2021, the long-term inflation expectations of the bond market as of Tuesday 02/01/2022 are fore inflation of just +2.43% per year over the next 10 years. (source: Federal Reserve Bank of St. Louis, 10-Year Breakeven Inflation Rate, BTN Research).

Click here to see the full review.

—

Source: Bloomberg. Asset-class performance is presented by using market returns from an exchange-traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High-Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 31% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.