Quick Takes

- Russia Invades Ukraine, Markets Stumble. With risk assets now fighting on two fronts-persistent inflation and a conflict between Russia and Ukraine-nearly all asset classes posted a negative month for the month of February.

- Yields Post a Volatile Month. With expectations for the initial liftoff in interest rates to occur next month and heavy flows into haven assets during the month, yields on Treasury bonds went for a rollercoaster ride for the month of February, but ultimately ended the month higher.

- Greenback Soars as a Haven Currency. The dollar caught a bid for the month as market participants priced in higher fed funds rate in the US, but also on the premise of being a haven currency as the Russian Ruble plummeted.

- Supply chains, Labor Markets, and Inflation. Yet again, inflation came in at levels not seen since the 1980s, but PPI may have shown the initial signs of rolling over during the month. Labor markets remain extremely tight, bolstering the Fed’s hawkish tone and supply chains continue to exert upward pressure on inflation.

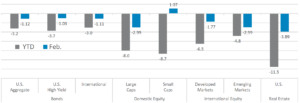

Asset Class Performance

Markets deepened their year to date sell off as Russia invaded Ukraine and governments and businesses alike sanctioned or shunned the Russian economy. Domestic Small Cap equities were the only asset class in the green for the month and all asset classes are in the red for the year so far.

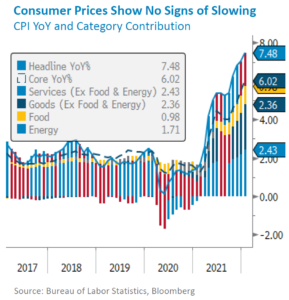

Inflation Continues Running Red Hot

Throughout the month, Fed members continued their rhetoric to make combatting inflation a top priority. This narrative only increased as the Consumer Price Index (CPI) for the month came in at an astounding +7.5% on a year over year basis for the previous month. Even after excluding the volatile components of Food and Energy prices, so called Core CPI was still up +6.0% on a year over year basis, which represents the largest increase the US has seen since 1982. With inflation increasing at such an alarming rate, this all but guarantees that the Fed will initiate an increase in the Fed Funds Rate at the March meeting. Given inflation’s persistence on moving higher and higher, the door is open to an initial +50bps increase in interest rates versus the previously assumed +25bps hike.

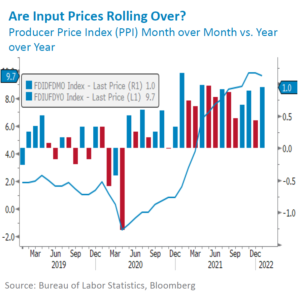

This persistent inflation reading has also added some fuel to the fire for more frequent increases in interest rates to cool down the economy. Several major asset management shops increased their predicted number of interest rate hikes, with some seeing the possibility of seven increases through the year. While the Fed appears to be playing catchup with getting consumers’ prices under control, input prices for producers, as measured by the

Producer Price Index (PPI), may have shown the initial signs of rolling over during the month. While the month over month reading came in at double the pace expected, +1.0% versus consensus of +0.5%, the year over year measure fell from its peak achieved early in the fourth quarter of last year. If producers can get control of their input costs, this could alleviate some of the upward pressure on inflation and call for a more measured and gradual tightening of monetary policy from the central bank rather than the accelerate pace that some market participants are now calling for.

Bottom Line: Economic data releases for the month of February continued to show persistent inflation, ever tight labor markets, and improving, but still snarled supply chains. Producers showed a modicum of relief in their rising input costs, but prices remain elevated. Putting all the data together, it seems to be all but guaranteed that the Fed will raise interest rates by +25bps during the central bank’s March meeting, and the door is open for a +50bps hike in March. Additionally, the red-hot data readings are beginning to add ammunition to the case for more frequent rises in interest rates for the rest of the year.

Click here to see the full review.

©2022 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.