Quick Takes

- Risk Assets Catch a Bid. Risk assets screamed ahead for the month of November after the inflation reading, as measured by the Consumer Price Index (CPI), came in softer than expected.

- Will the Fed Slow its Tightening? With inflation coming in softer than expected, market participants began to speculate that the Fed will slow its pace of monetary tightening in the coming months. Chairman Powell’s commentary at the end of the month hinted that further hikes in interest rates may be smaller in the future but that rates will likely be higher for longer.

- Greenback Weakens on Fed Speculation. After a massive run up for the year thus far, the dollar finally began to weaken against other major currencies on the back of speculation that interest rate hikes conducted by the Fed may moderate in the future.

- Economic Production and Labor Markets. Despite inflation coming in below market expectations, annualized GDP for the third quarter of the year came in above expectations. Additionally, the Job Openings and Labor Turnover Survey (JOLTS) came in above survey estimates as well, hinting that the labor markets remain very tight despite the Fed’s year-to-date actions to tighten monetary conditions.

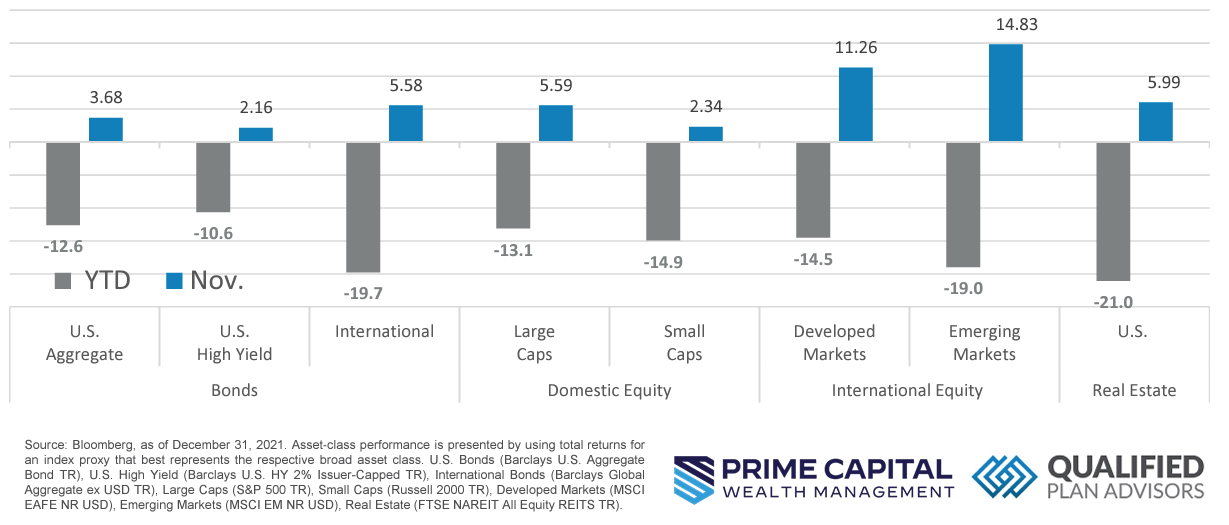

Asset Class Performance

Market participants went risk on for the month of November. While bonds and stocks alike were well into the green for the month, International and Emerging Markets were the best performing asset classes on the back of the dollar depreciating compared to other currencies and speculation that China may slacken their Covid protocol.

Markets & Macroeconomics

With a vast majority of companies now having third quarter results in the books and reconciled, corporate profits were surprisingly resilient given the year-to-date macro backdrop of rising input and labor costs as well as the Fed’s rapid and decisive action to tighten monetary conditions in the economy. As illustrated in the chart above, corporate profits retreated from their peak but remain well above levels seen prepandemic. While its encouraging to see that corporate profits have not taken a nosedive on the back of these difficult macro conditions, it should come as no surprise to anyone that if input costs are rising and financial conditions are tighter, that to retain these levels of profit, corporations must pass these increases on to the end consumer. Many consumers have already felt this pain at the checkout register individually, but overall US Personal Consumption for the third quarter came in above expectations of +1.6% at +1.7% (source: Bureau of Economic Analysis). Despite consumers spending more than expected, inflation, as measured by the Consumer Price Index (“CPI”), came in softer than expected for the month of October at +7.7% on the year-over-year metric versus market expectations of +7.9% (source: Bureau of Labor Statistics). Digging into the underlying CPI components, services were flat from the previous readings and there was less of increase in the energy, food, and commodities portion as compared to the previous reading. Again, this further illustrates that businesses are passing along cost increases to the consumer, but we are starting to see some hints in price increases moderating at some of the areas worst hit by the pandemic, i.e., energy and commodities. As we continue to see the Fed maintain tight, and possibly continue to tighten, financial conditions to moderate aggregate demand, it’s possible that consumers may start to see less price increases in the future as the effects of slowing down the economy work their way through the system.

Bottom Line: Overall, corporations have been relatively successful at passing increased input and labor costs onto the end consumer, which means that profit margins have been resilient despite the difficult backdrop of high inflation and the Fed tightening financial conditions. As many consumers have already noticed, this means higher prices at the checkout register, but with CPI coming in below expectations, this could be a hint that price hikes have peaked and may start to moderate as the effects of the Fed’s swift tightening of monetary conditions continue to work their way through the US economy.

Download the full review.

©2022 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.