Quick Takes

- Risk Assets Scream Ahead. Risk assets took off for the month of June, with almost all major indices ending well into the green and locking in a healthy first half of the year return.

- Cooling Inflation Data. Inflation, as measured by the Fed’s preferred data point of PCE Deflator, continued to show signs that inflation is increasing at a slower rate, i.e., disinflation. Despite this positive sign on the battlefront for taming inflation, Fed speak took on a hawkish tone after the June FOMC meeting.

- Dollar Loses Steam. The greenback spent the majority of the month in a steady state of decline as market participants initially priced in a pause, if not all out stop, to interest rate hikes. After the Fed’s hawkish tone post the FOMC meeting, the dollar regained some ground from its low point but ended the month lower than the start of the month.

- Labor Markets, Economic Production, and Personal Spending. The Unemployment Rate ticked up to 3.7% for the June reading and GDP for the first quarter was revised sharply higher, but signs of stress are lingering with Consumer Spending showing signs of softening.

Asset Class Performance

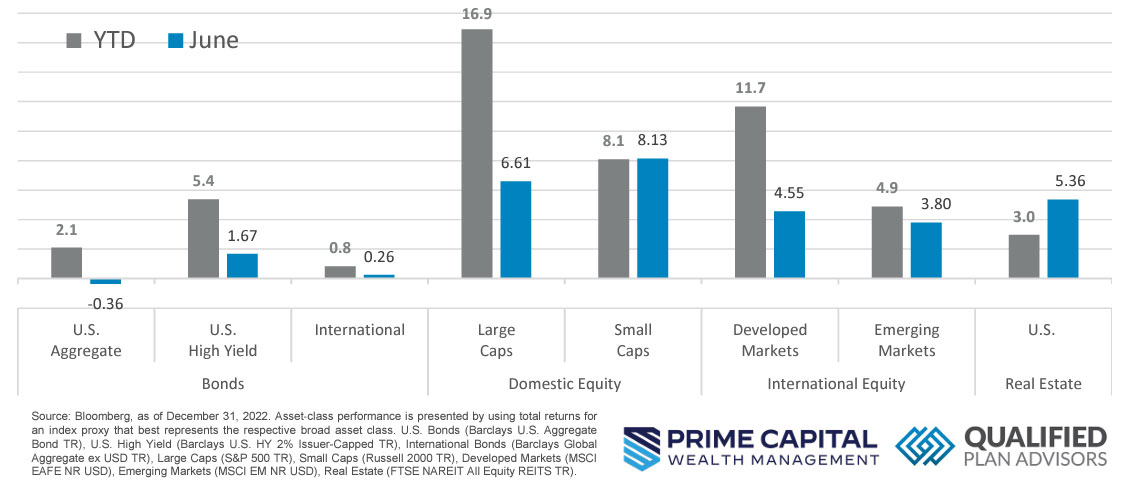

June turned out to be a stellar month for risk assets with domestic and international markets locking in a healthy return for not only the month but also the first half of the year as market participants began to price in a higher probability of a soft landing on the back of several positive economic data readings.

Markets & Macroeconomics

Inflation continued to show signs of softening as the June reading of PCE Core Deflator, the Fed’s preferred metric for measuring inflation, came in softer than expectations of +4.7%, landing at +4.6%. Compared to 06/30/2022 when PCE reached its recent maximum level of +7.0% on the year-overyear metric, progress has certainly been made on battling entrenched inflation. While this progress is encouraging, the war is far from over with the Fed maintaining that it will tighten monetary policy until its long-term target of +2.0% is reached. The process of getting inflation from +7.0% to 4.0%, which it appears to be trending in that direction, will be one battle, but many market participants believe that the road from +4.0% down to +2.0% will be very different. Time will tell what actions the Fed will take to achieve this acceptable level of inflation, but just as important, if not more so, are the downstream effects these methods will have on the economy. As illustrated in the chart above, the Fed’s rapid increase in policy rate has begun to impact the US consumer. Personal Consumption Expenditures have been steadily increasing at a declining pace since the start of the year. Additionally, on an inflation-adjusted basis, Personal Consumption has effectively been flat since the first month of the year, with the exception of April where there was a healthy bump up. Market participants have long speculated that the consumer could be the key to a soft landing, i.e., no economic recession. If the consumer accelerates their cut back in expenditures in the coming months, this could lead to a harder landing than what the Fed has been shooting for. Additionally, Chairman Powell’s tone after the Fed’s meeting in June took on a hawkish tone with the Chairman stating that additional rate hikes could be coming later this year.

Bottom Line: Inflation, as measured by the PCE Core Deflator came in softer than expected at the June data reading. It appears that inflation is increasing at a slower pace, which is what the Fed has been shooting for with their rapid tightening of monetary policy. While inflation has been slowing, it appears that consumers are starting to feel the downstream effects of this tighter monetary policy with Consumer Expenditures also showing signs of increasing at a slower pace and when adjusted for inflation, Personal Consumption has been flat for most of the year. Consumers have long been speculated as the path to a soft landing and their spending behavior will remain top of mind for market participants as the Fed continues to battle inflation back to their targeted level of +2.0%.

©2023 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

© 2023 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.