The Bottom Line

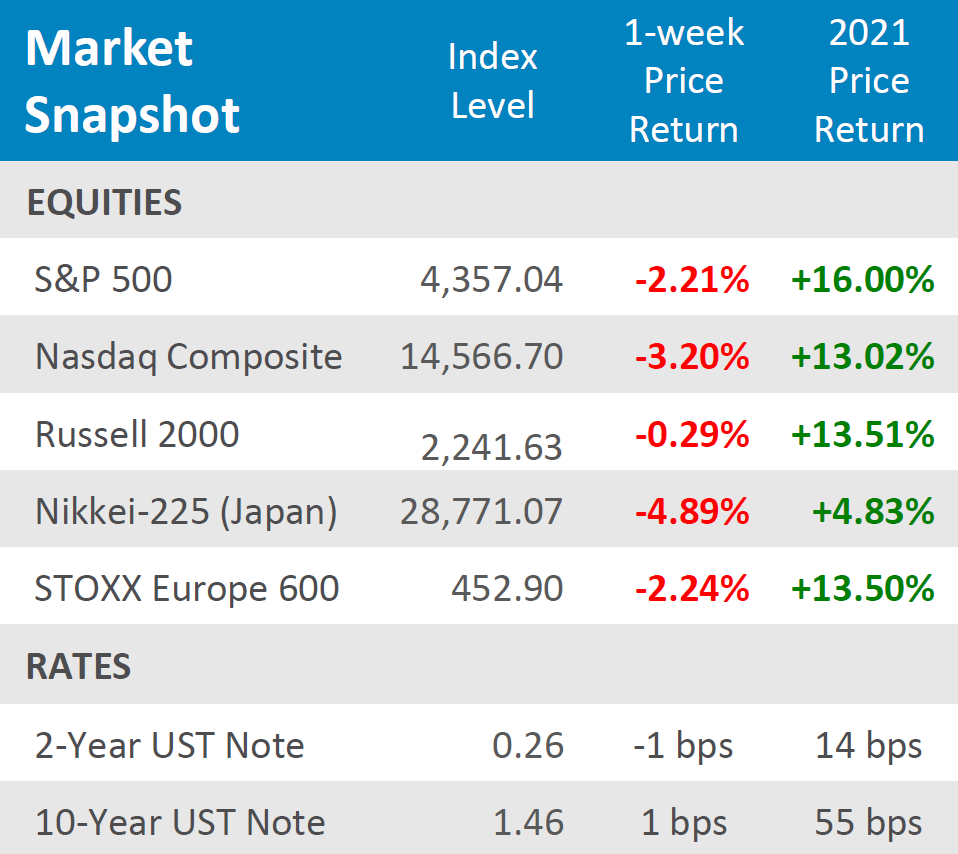

● Equities had their worst day since March of 2020 on Tuesday and losses continued until Friday. Domestic equities rose on Friday, but international equities fell further.

● The 10-Year yield climbed to 1.567% on Tuesday, its highest level since June, but ended the week modestly up + 1bps. The 2-year yield fell -1bps for the week.

● The week was jam packed with economic news as the week, month, and quarter ended. GDP and Personal Consumption for Q2 came in just above expectations, but Consumer Confidence reached a seven-month low and jobless claims continued their trend of missing consensus.

Yields Rise, Stocks Fall

As market participants began to price in the Fed’s hawkish tone and possible sooner than expected hike in interest rates, the yield in the 10-year treasury began to liftoff. Duration assets, mainly growth equities that lean on the debt market to finance their growth aspirations and longer dated bonds, sold off heavily on Tuesday. The Nasdaq had its worst day since the global pandemic began but was able to trim some losses on Friday. Ultimately, the tech heavy index finished -3.20% for the week. The S&P 500 did not fair much better as it sold off -2.21% for the week. The Russell 2000 fought to gain positive ground for the week on Friday, but sellers ultimately won, the index was down -0.29% for the week. Domestic equities took international equities with them as the greenback rose to its highest level since November of 2020. European equities, as measured by the STOXX Europe 600, were down -2.24% for the week and the Nikkei-225 cut its YTD return in half, down -4.89% for the week after Fumio Kishida was elected to succeed Yoshihide Suga as Prime Minister on Wednesday. While the bloody week on Wall Street left risk assets battered, their healthy YTD returns remain largely intact.

Digits & Did You Knows

IN THE MIDDLE – After adjusting numerical data from the past for the impact of inflation, the US median household income reached an all-time high for 4 consecutive years

(2016-2019), peaking at $69,560 in 2019. That streak ended in 2020 when median household income dropped to

$67,521. Before 2016, the peak for median household income was $63,423 from 1999 (source: Federal Reserve Bank of St. Louis, BTN Research).

VOTING – With a 220-212 majority in the House (there are 3 vacancies), House Democrats can lose 3 members and still pass legislation on a party line basis, i.e., 3 defections still provides a 217-215 margin(source: House, BTN Research).

Click here to see the full review.

—

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange‐traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐YieldBond(iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 ValueETF);MidGrowth(iSharesRussell Mid‐CapGrowthETF);MidValue (iSharesRussell Mid‐Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2021 Prime Capital Investment Advisors, 6201 College Blvd., 7th Floor, Overland Park, KS 66211.