The Bottom Line

● Equity markets around the globe deepened their year-to-date losses as tensions between Russia and Ukraine heightened throughout the week.

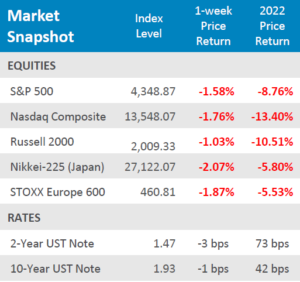

● Bonds reversed their selloff from last week as investors searched for havens, the yield on the 2-Year fell -3bps and the yield on the 10-Year fell -1bps.

● Economic news for the week was almost completely overshadowed by the situation in Ukraine, however, data for the week illustrated that sticky inflation has persisted into the new year and while housing starts disappointed, home demand is still robust with pending sales coming in well above consensus expectations.

Geopolitical Tensions Go Up, Markets Go Down

The week started off with markets rejoicing that Russia claimed to be pulling back troops from the Ukraine border on Tuesday, but this was short lived as the US government announced that it did not see any evidence of troop withdrawals on Wednesday and cautioned market participants during the latter half of the week that an invasion is still on the table. This narrative sent equities spiraling on Thursday and the pain continued into Friday. The S&P 500 lost -1.58% for the week and Small Cap equities, as measured by the Russell 2000, lost 1.03% for the week. The tech-heavy Nasdaq Composite was hit hard on the news of geopolitical tensions were increasing, falling -1.76% for the week. International equities also sold off this news with Japanese equities, as measured by the Nikkei-225, fell -2.07% for the week. With the threat of increased energy prices in Europe, European equities, as measured by the STOXX Europe 600 fell by -1.87% for the week. The tensions between Russia and Ukraine seem to have market participants’ undivided attention, but with the US set to release GDP numbers next week, this may shift to the backburner.

Digits & Did You Knows

FINALLY IN THE BLACK – The US Government ran a $119 billion surplus in January of 2022,, breaking a streak of 27 conservative months of deficits, and its first surplus month during the pandemic. (source: BTN Research).

DREAM HOME – Ground was broken in the United States on the construction of 111,600 single-family homes in June 2021, the largest monthly total nationwide since September 2006. The 1.12 million housing starts in all of calendar year 2021 was the largest US total reported since 2006. (source: Census Bureau, BTN Research)

Click here to see the full review.

—

Source: Bloomberg. Asset-class performance is presented by using market returns from an exchange-traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High-Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 31% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.