The Bottom Line

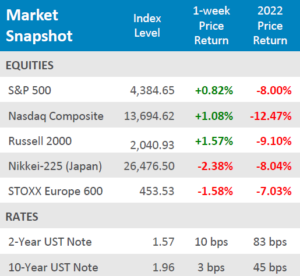

● Despite a swift and bloody selloff in global risk assets in the middle of the week, US Equities were able to post a weekly gain.

● Bond yields spiked during the first half of the week, but began moderating the final days of the week, the yield on the 2-Year rose 10bps and the 10-Year rose 3bps.

● Economic data releases were initially ignored by market participants on the news of Russia invading Ukraine, but traders started paying attention after GDP for the final quarter of 2021 landed in line with expectations and Personal Income and Spending was stronger than expected.

Russia Invades Ukraine, International Markets Selloff

Despite global markets initially selling off on the news that Russia was invading Ukraine, domestic equities were able to recover their losses sustained at the beginning of the week, and even posted a solid week in the green. The S&P 500 rose + 0.82% for the week and the tech-heavy Nasdaq Composite was up even more, +1.08% for the week, but still deeply in the red for the year so far. Small Cap equities, as measured by the Russell 2000, were able to best the Nasdaq, climbing

+ 1.57% for the week. International markets didn’t fair as well as domestic equities. European equities, as measured by the STOXX Europe 600, fell -1.58% for the week as market participants priced in the potential impact the situation in Ukraine may have on European markets. Despite having several positive economic data releases, Japanese equities, as measured by the Nikkei-225, fell by -2.38% for the week. While traders in US markets have shaken off the potential impact of the conflict in Ukraine may have, market participants will closely watch any developments that may come in the next several days. Additionally, employment data releases next week should capture investors’ attention.

Digits & Did You Knows

THE PRICE OF ELITE – The average 1-year cost of tuition, fees, room and board at a private 4-year American college for the 2021-2022 school year was $50,580.. (source: College Board, BTN Research).

THE BIGGEST – The 4 largest monthly budget deficits in US history occurred over a 12-month stretch beginning in April 2020. The 4 months were April 2020 ($738 billion deficit), May 2020 ($399 billion deficit), June 2020 ($864 billion deficit), and March 2021 ($660 billion deficit). (source: Treasury Department, BTN Research)

Click here to see the full review.

Source: Bloomberg. Asset-class performance is presented by using market returns from an exchange-traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds may be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High-Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4%Mid Value, 2% Small Growth, 2% Small Value, 31% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.