Quick Takes

- Risk Assets Decimated. April was a bloody month for risk assets across the board. Equities, both domestic and abroad, sold off significantly for the month of April and Bonds, offered little to no protection from the pain.

- Has Inflation Finally Peaked? On the heels of the Fed initiating interest rate liftoff and offering some details on their path to quantitative tightening, Core CPI came in softer than expected. While this is encouraging, it is still too early to tell if Inflation has peaked and will show signs of normalizing.

- Greenback Soars To 5 Year High. As the Fed gave more clarity to their quantitative tightening process, the dollar took off for the month of April and reached a 5-year high of 103.928 at the end of the month.

- Economic Production, Labor Markets, and Inflation. GDP missed the mark for the month of April, falling -1.4% versus expectations of +1.0%. Inflation, as measured by Core CPI, came in below expectations for the month of April. Labor markets appear to have leveled off for the month of April with most of the high frequency data coming roughly in-line with market participant expectations

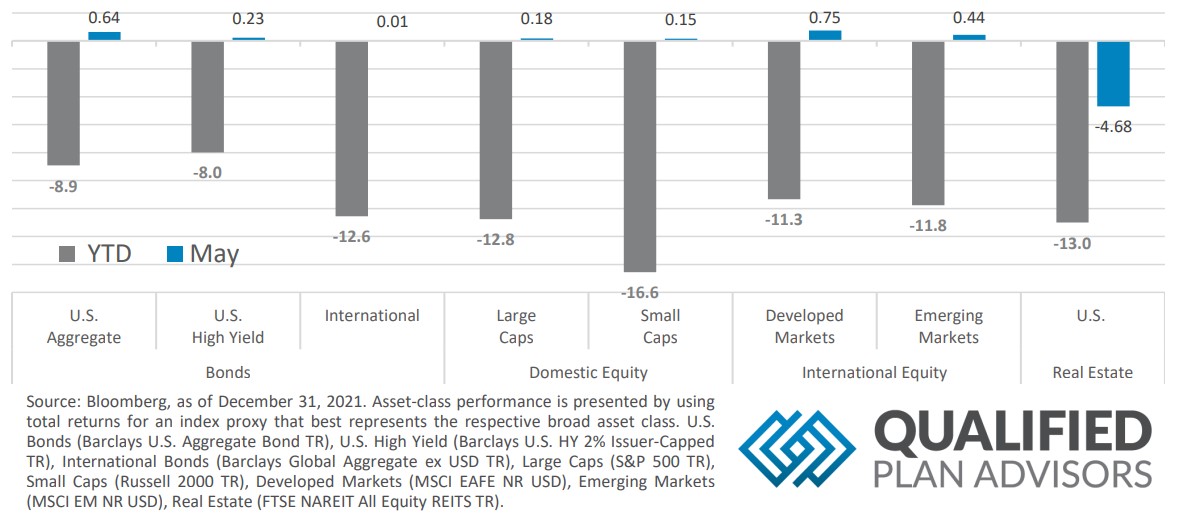

Asset Class Performance

May was a rollercoaster for risk assets with most starting the month on a sharp upward swing, only to fall almost immediately back into negative territory for the month. As the month went on, the volatility continued, but risk assets went on a final run towards the end of the month with almost all asset classes ending in the green for May.

Markets & Macroeconomics

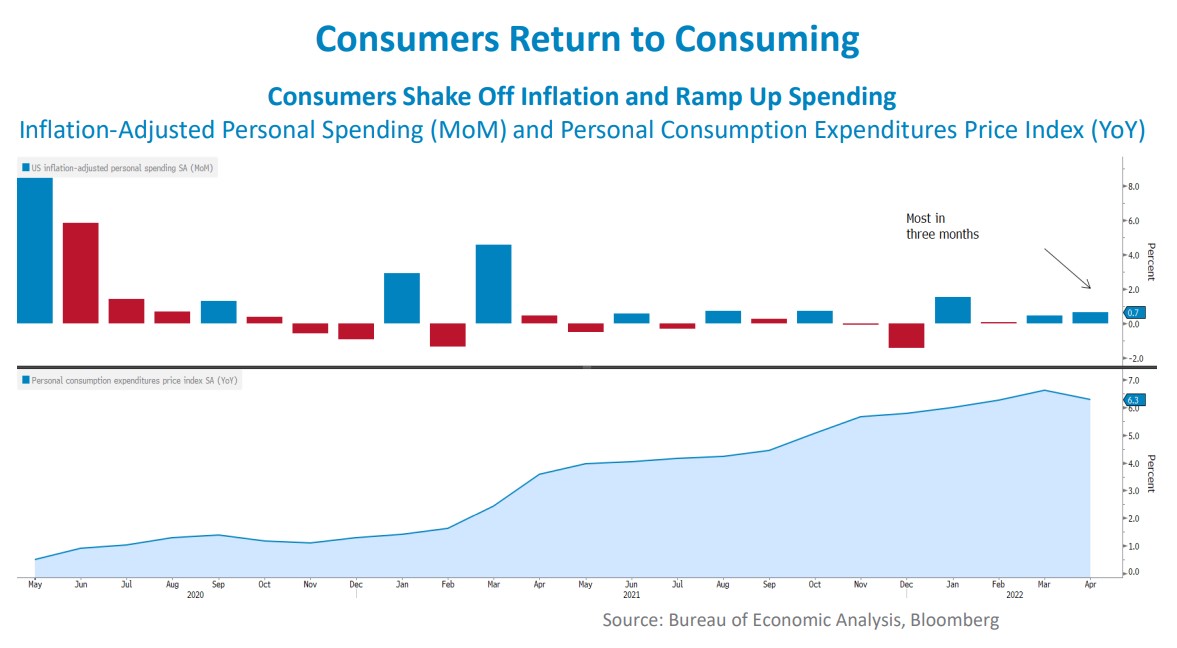

Inflation, as measured by the Consumer Price Index (CPI), continued its trek higher, but at a slower pace than previous readings. On the year-over-year metric, CPI rose by +8.3%, which was much more moderated than the reading the month before of +8.5%. While one reading doesn’t make a trend, this could be the initial signs of inflation beginning to moderate as the Fed ramps up their monetary tightening activities. The combination of the Fed’s actions and the global effects of the war between Russia and Ukraine have battered US Consumer Confidence. The University of Michigan Consumer Sentiment Index fell to 58.4, approaching levels we haven’t seen since the fallout of the Great Financial Crisis during 2009. Despite this dismal backdrop, US Consumers increased their rate of spending by the highest rate thus far for the year on an inflation-adjusted basis. Real Consumer spending rose by +0.7% for the May reading. To post this strong reading, it appears that consumers had to dip into their savings to fund their purchases with the Personal Savings Rate falling to 4.4%, also a level not seen since the Great Financial Crisis. While a falling savings rate may not initially sound like a positive, given the robustness of consumer balance sheets on the tail end of the global pandemic, it is likely that consumers’ balance sheets have ample room to allow more spending versus savings over the short to intermediate term. This is especially encouraging given that the Fed has conducted their interest rate liftoff, with the intention of slowing economic growth back to a more sustainable level. The Fed has a difficult job of tempering economic growth, but not so much that it sends the US economy into a recession. If consumers continue to consume, this could act as a golden parachute for the Fed as they pump the brakes on economic production, but it will likely be akin to balancing on a tightrope as the Fed pursues the goldilocks economy of not too hot, but not too cold.

Bottom Line: Despite a challenging backdrop for the US economy, and the rest of the globe, brought about by rampant inflation, tight labor markets combined with low labor force participation, tightening monetary policy by the Federal Reserve, and geopolitical tensions, the US Consumer posted their strongest Real Personal Spending for the year at the May reading. As the Fed attempts to slow down the economy via interest rate rises, continued robust US consumer spending could act as a saving grace for the Fed as they attempt to wrangle inflation while keeping economic growth positive.

©2022 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.