Quick Takes

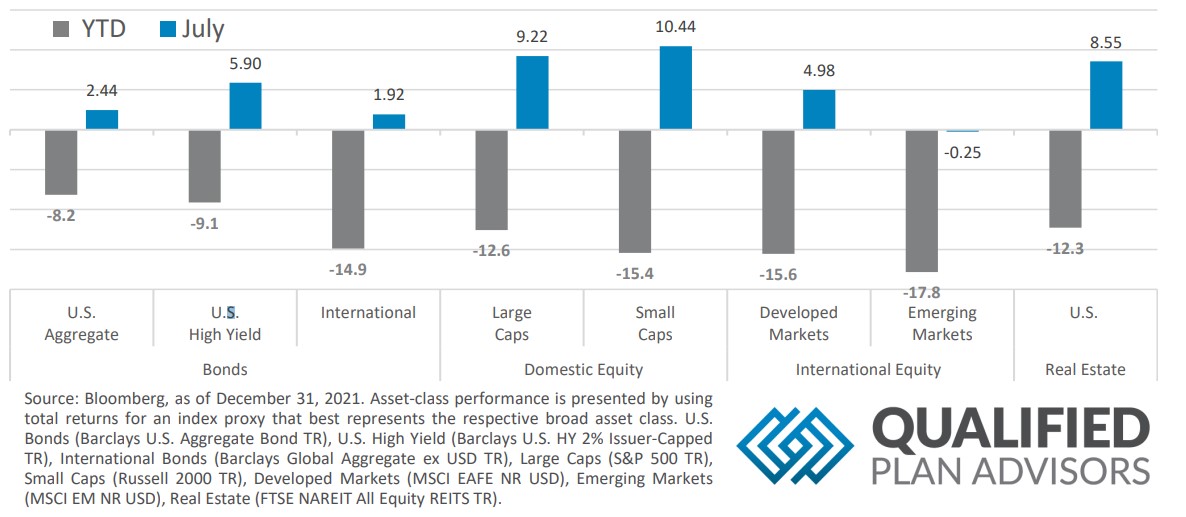

- Risk Assets Catch a Bid. Risk assets reversed their year-to-date downward spiral for the month of July, almost all asset classes were in the green and then some.

- Markets Shrug Off Rate Hike. The Fed conducted another supersized 75bps hike in interest rates during their July meeting, but risk assets seemed pleased with the move and Chairman Powell’s comments after the meeting. Powell hinted that the rates might be at, or at least very close to, neutral.

- Greenback Resumes Grind Higher. Like the previous month, the dollar spent the first half of the month climbing upward but lost steam around the midmonth point, finally settling a little higher than it started the month.

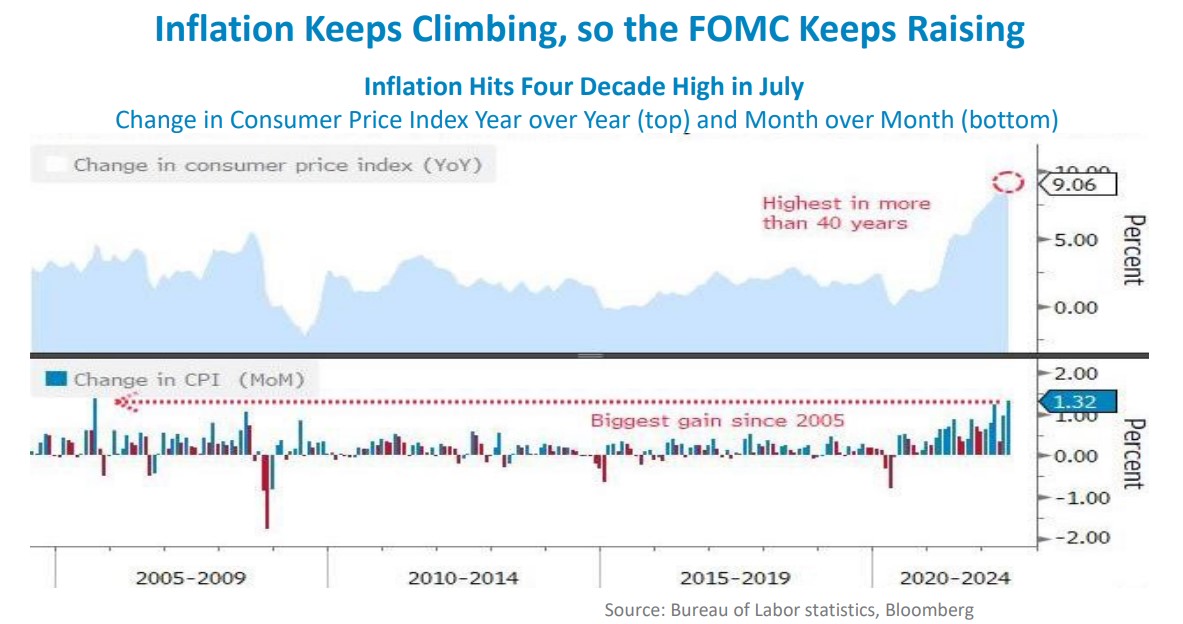

- Labor Markets and Inflation. While markets reversed their downward trend for the month, Inflation did not reverse its grind higher with CPI hitting the highest level in more than 40 years. As the inflation keeps climbing and the Fed has raised rates to combat this, labor markets have begun to show signs of loosening with jobless claims ebbing up. (source: Bureau of Labor Statistics)

Asset Class Performance

Market participants went risk on almost across the board and in a big way for the month of July. Equities were up close to 10% for the month and bonds posted a solid month as well. International Developed equities were positive

too, but Emerging Markets were left behind for the month, down slightly at -0.25%.

Markets & Macroeconomics

Much to market participants’ chagrin, inflation continued its grind higher. Inflation, as measured by the Consumer Price Index, posted its biggest year‐over‐year change in over 40 years, up +9.06%. On the month‐over‐month change, CPI rose +1.32%, which the chart above highlights that this represents the biggest change since 2005. While most market participants were expecting a period of inflation ticking above the approximate 2% the US was seeing prepandemic, most were expecting inflation to subside to a much lower number and were also expecting it to happen much quicker. With inflation running hot and sticky thus far this year, the FOMC has responded by jacking up interest rates with larger than normal increases in the interest rates. The FOMC determined that another hefty 75bps increase was warranted given inflations persistence. This brings the Fed’s target band range to 2.0%‐2.25%. Typically, increases in interest rates are negative for risk assets because additional growth that needs to be financed via debt becomes more expensive which then hurts bottom lines for companies. This isn’t limited to corporations; consumers also feel the pain of debt becoming more expensive and will often need to make lifestyle adjustments to ensure they can continue to pay their mortgage, car loan payment, or any purchases that were financed via debt facilities. This will thus impact future purchases and should ultimately help to slow down the economy and hopefully inflation with it. While it appears that the Fed is taking the right steps with the markets cheering on their decision, it will still take time for the full effects of these to work their way through the economic system. This highlights the tightrope walk that the Fed is engaged in with slowing the economy just enough to keep it growing at an acceptable but not overheated level, while preventing overreactions in monetary tightening to ensure that growth doesn’t contract for a sustained period.

Bottom Line: With inflation hitting its highest level in four decades, the Fed conducted another larger than usual increase in interest rates of 75bps, bringing their target band range to 2.0%-2.25%. Tightening financial conditions in this manner should help to cool the economy back to a more sustainable level of expansion while also bringing inflation back down to less oppressive levels. The difficulty in this act is to cool the economy just enough, but not so much that it sends the US economy (and possibly other economies across the globe) into a recessionary period.

©2022 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.