Quick Takes

- Risk Assets Resume Selloff. Risk assets posted another negative month as the market selloff resumed on the heels of Powell’s hawkish Jackson Hole speech.

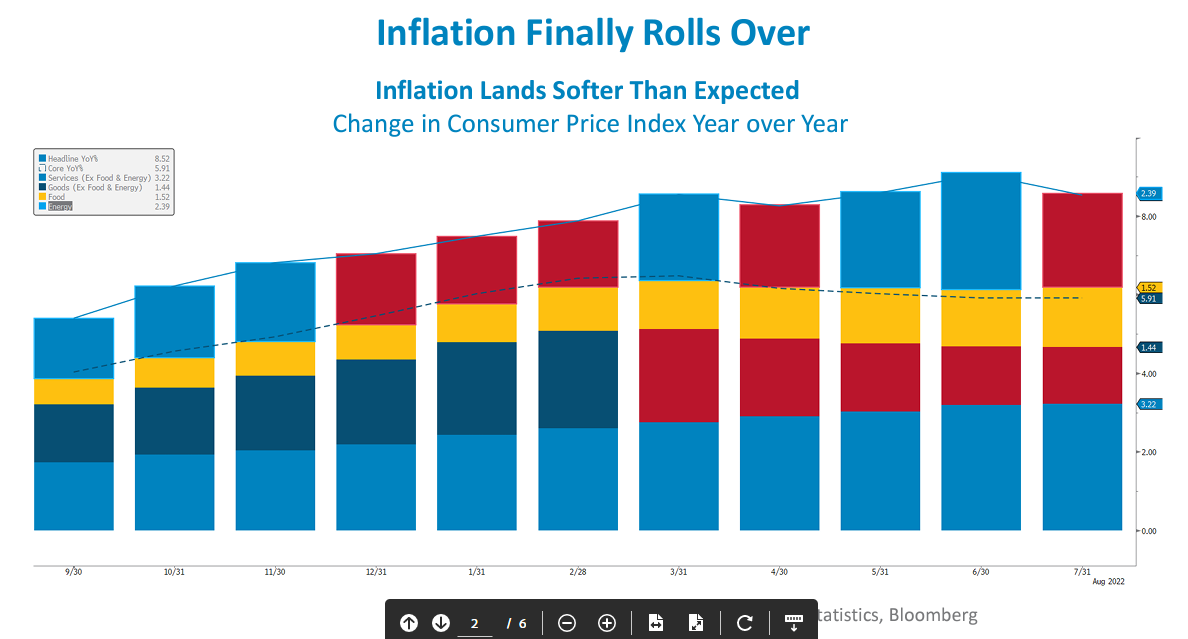

- Inflation Rolls Over and Rates Go Higher. After Powell’s warning comments, the yield on the 10‐year resumed its ascent which pulled down bonds and equities alike. This all occurred despite inflation showing its initial signs of cooling. Inflation’s impact on monetary policy seems to be the main deterrent from markets.

- Greenback Continues Grind Higher. The dollar spent most of the month grinding higher but finally retreated from its high the final few days of the month. Despite this last‐minute retreat, the greenback remains near record high levels.

- Labor Markets and Inflation. The Unemployment Rate fell to 3.5% as the jobs market retained its robustness despite the recent rate hikes conducted by the Fed. Inflation, as measured by CPI, showed its initial signs of relenting its stubborn climb higher, but Powell warned that the war on rampant inflation was far from over.

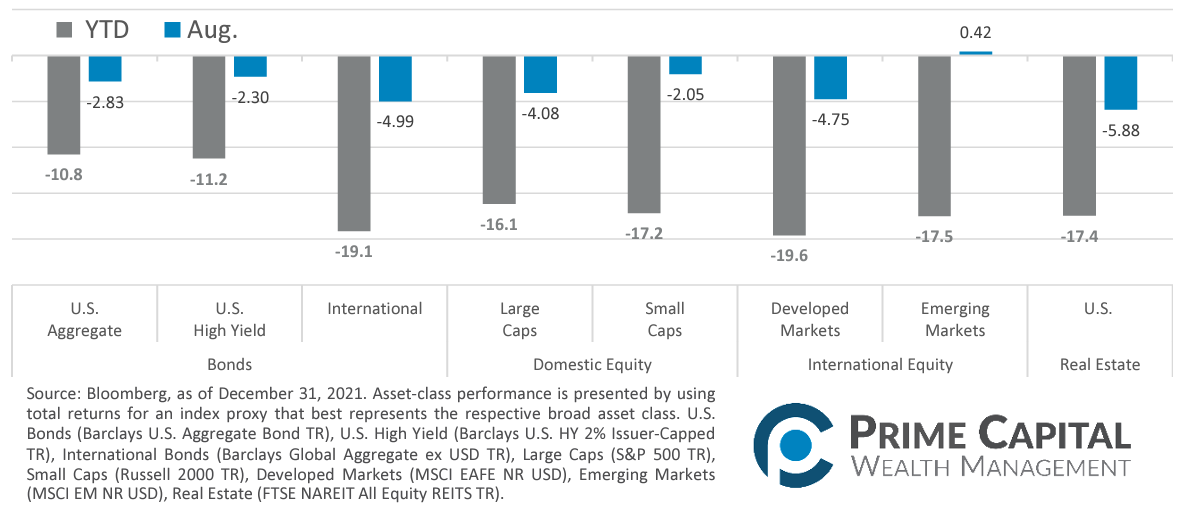

Asset Class Performance

To the relief of many market participants, inflation, as measured by the CPI, finally rolled over. Despite this positive signal, markets turned negative as Powell warned that the battle against inflation was far from over. Equities and Bonds bothposted an abysmal month,but EmergingMarkets equities were able to eek out a positive month.

Markets & Macroeconomics

Giving market participants a reason to cheer, inflation, as measured by the Consumer Price Index (“CPI”), came in cooler than expected at +8.5% versus survey estimates of +8.7% on the headline year‐over‐year measure. While one positive data reading certainly does not make a trend, this could be the initial sign that the Fed’s tightening of monetary policy is beginning to work its way through the economy. Rather than taking the stage to declare victory, Chairman Powell’s commentary at the Fed’s Jackson Hole Economic Symposium was decisively hawkish, warning market participants that further actions will likely be necessary to achieve price stability and return inflation to the Fed’s longterm target range of around +2.0%. Powell warned that swift decisive action is preferred, rather than a longer period of softer action. After Powell’s comments, interest rates resumed their climb higher with the yield on the 10‐Year Treasury jumping up +54bps for the month, landing at 3.19% and the yield on the 2‐Year Treasury rose even more at +61bps for the month, ending at 3.49%. With interest rates climbing higher again, equity and bond valuations alike suffered for the month of August. Almost every risk asset class was in the red for the month with growth equities being amongstone of the worstperformers. To achieve higher levels of growth, these companies must often source capital from the debt markets. With interest rates grinding higher, this makes the cost of capital to these companies more expensive and thus a lower valuation is demanded by the market. Additionally, labor markets remain tight with the unemployment rate hitting 3.70% at the August reading, however that data is backward looking and is often revised at later readings as data becomes available. Many companies have announced hiring freezes, if not outright employee layoffs. So, it remains to be seen if the Fed’s actions have been sufficient to cool the labor markets to a more sustainable level of matching labor demand with labor supply.

Bottom Line: Inflation showed the initial signs of cooling, but the Fed warned that the battle was far from over and more decisive action in the short-term is preferred to a longer-term softer approach. Labor markets continued to show resilience in remaining tighter than the Fed would like, but this may be due to the delay in available data as many companies have announced hiring freezes or even layoff plans. The combination of these events led market participants to return to selling and risk assets tumbled for the month of August.

©2022 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory services offered through Prime Capital Investment Advisors, LLC. (“PCIA”), a Registered Investment Adviser. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”).

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.