Quick Takes

- Risk Assets Stumble. Risk assets lost steam in February with a majority posting a negative month, but most are still in positive territory for the year thus far.

- Fed Raises Rates Again. The Fed implemented yet another rate hike in the month of February, but they bucked their recent trend and only raised by 25bps. While the hike was more in line with historical raises, the rhetoric from members for the month hinted that further rate hikes will be necessary in the coming months and will likely keep rates “higher for longer”.

- Greenback Resumes Grind Higher. On the back of the increase in interest rates and maybe even more impactful, the Fed members’ rhetoric sent the dollar higher versus other major currencies, which negatively impacted international assets, especially emerging markets.

- Labor Markets and Inflation. For the February reading, Unemployment fell to a 53-year record low of 3.4% and several inflation metrics came in higher than expected, with previous readings being revised upward as well. This led to a downward revision in economic production from the final quarter of last year.

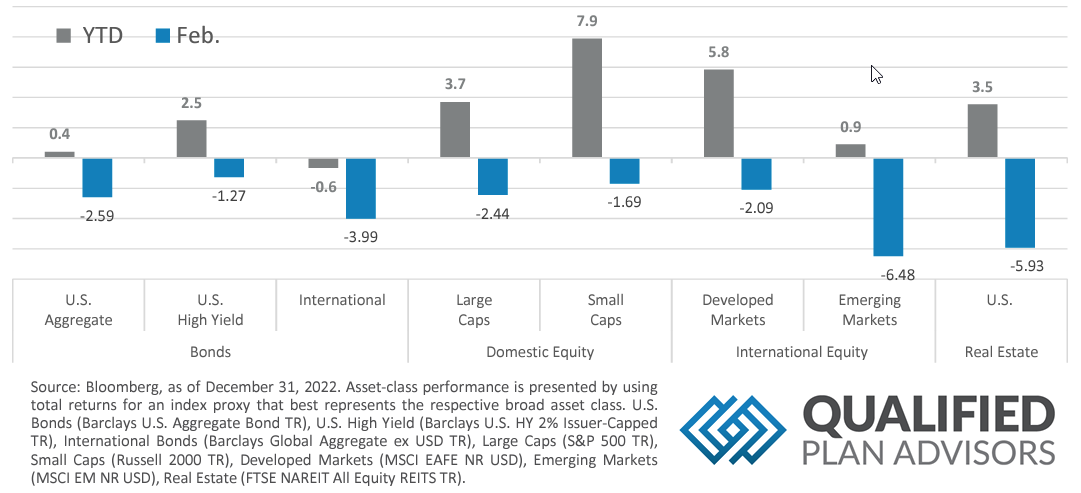

Asset Class Performance

Market participants went risk off on the back of the Fed’s increase in interest rates and guidance that more rate hikes will likely be necessary in the coming months. Most major asset classes were negative for the month with Emerging Market equities leading the drawdown on the back of a stronger dollar for the month.

Markets & Macroeconomics

Yet again, the Unemployment Rate in the US dropped for the month of February, coming in at 3.4%. This represents the lowest level since May of 1969. In January, the US added +517,000 jobs, well above economists’ estimates of +223,000. This surprise in jobs comes on the back of a multitude of corporations announcing layoffs, especially those in the manufacturing and technology sectors. Putting the surprise together with the layoff announcements illustrates just how tight the demand for labor remains, despite several industries showing signs of slowdown. Additionally, wage growth has remained fairly stable with Average Hourly Earnings coming in at +0.3% for the month of December and +4.4% on the year-overyear metric. The strong labor market and wage growth comes on the back of the Fed’s rigorous monetary tightening campaign to reign inflation in and has thus far defied the conventional playbook. Typically, when the Fed tightens monetary policy, the unemployment rate will begin to tick up as economic production begins to taper off and eventually, this should help to decrease upward pressure on prices, i.e., inflation. This time around, labor markets are retaining their tightness despite an unprecedented Fed tightening policy and inflation has remained persistently sticky, while economic production has held up but is starting to show signs of softening. It is likely that the Fed will continue to tighten monetary conditions until inflation shows substantial signs of softening, which could lead to the US economy entering a recessionary period to tame inflation. Strong labor markets and wages could act as lifeline for the US economy and keep, or at least soften the blow of a recession.

Bottom Line: Curiously, Labor Markets remain extremely tight despite the Fed’s campaign to tighten monetary conditions in their combat against persistently high inflation. The strong Labor Markets and stable wage growth could help to offset some of the negative impacts of monetary tightening and help to soften the blow to economic production. On the flip side, continued wage growth could also apply upward pressure on prices.

©2022 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

© 2022 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.