Quick Takes

- Risk Assets Mixed Start. Market participants went slightly risk-off for the start of the year with Large Cap equities, both domestic and international, posting positive performance while most other risk asset classes were in the red for the month.

- Inflation Continued Softening. Inflation, as measured by the Fed’s preferred metric of PCE Deflator, dipped below the +3.0% mark, coming in at +2.9% on the year-over-year metric. Despite this encouraging news, Fedspeak led most market participants to adjust future rate cut expectations to later than anticipated at last year’s end.

- Greenback Strengths in January. The dollar spiked against other major currencies mid-month as market participants adjusted future rate expectations. It ended off its highs for the month but was still well above levels at the end of last year.

- Personal Spending and Labor Markets. Personal Spending came in hotter than expected for the month of December, landing at +0.5% versus expectations of +0.3%. Labor Markets continued on their resilient streak with the Job Openings and Labor Turnover Survey, “JOLTS”, coming in above expectations of 8.75 million open positions, landing at a little over 9 million. The JOLTS report also showed that fewer workers quit into year end.

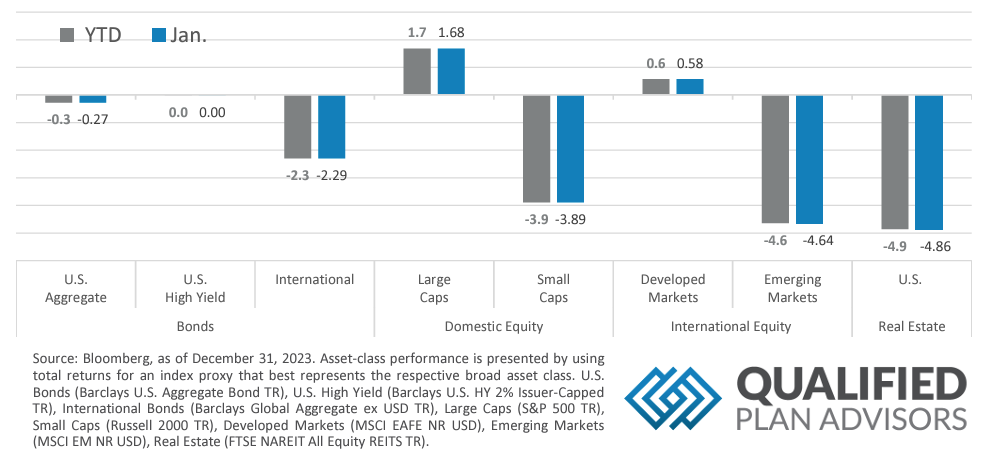

Asset Class Performance

Risk Assets posted a mixed start to the year with Large Caps and International Developed Markets posting positive results, whereas most other risk assets were in the negative for January. Domestic Real Estate and Emerging Market equities were the biggest losers for the month, but Small Cap equities weren’t far behind them.

Markets & Macroeconomics

The Job Openings and Labor Turnover Survey (“JOLTS”), a measure of employers searching for workers in the United States, finished last year on a strong note with open positions coming in at 9.03 million, above expectations of 8.75 million. Typically, the Fed operates under a dual mandate to keep inflation at sustainable levels and employment at high levels. The strength in the Labor Markets post-pandemic has enabled the Fed to take a break from focusing on the Labor Markets to solely devote resources to taming inflation. Strong Labor Markets have led employers to compete for workers. Many employers have complained of employees jumping ship to greener pastures and ultimately higher wages postpandemic. However, the JOLTS report also contains the Number of Quits, which has shown steady moderation over the past several months. This suggests that employees may not be as confident that the grass is truly greener on the other side of the fence. With this rollover in the Quit Rate over the past several months, wage growth has moderated and if the trend continues should continue to moderate even further. Moderating wage growth should further alleviate upward inflation pressure. While jobs are still aplenty and employees are quitting at a slower rate, an area of concern is layoffs. While wage growth is moderating, the damage has been done to corporations, with the higher post-pandemic employee cost Impacting operating and ultimately profit margins. Throughout 2023, corporations were busy with finding ways to reduce costs and keep margins at healthy levels with activity showing signs of moderating. With earnings season picking up at the end of January, multiple companies have already announced plans to reduce their workforce due to the higher employment cost. If this trend continues, it could jeopardize a soft-landing scenario and force the Fed to resume its dual mandate.

Bottom Line: Labor markets finished the year on a strong note with the JOLTS coming in above expectations of 8.75 million, at 9.03 million. The number of employees quitting their current jobs also moderated into the last year-end, suggesting that the Labor Market may shift into employers’ favor rather than employees’ in the coming months. While there are plenty of jobs available, layoffs are also ticking up as corporations attempt to rein costs in and ultimately keep margins at healthy levels. If this trend continues or shows signs of accelerating, the Fed may need to devote more attention to employment, ultimately returning to its dual mandate of keeping inflation and employment at long-term sustainable levels.

©2023 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Bloomberg. Asset‐class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

© 2023 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.