Quick Takes

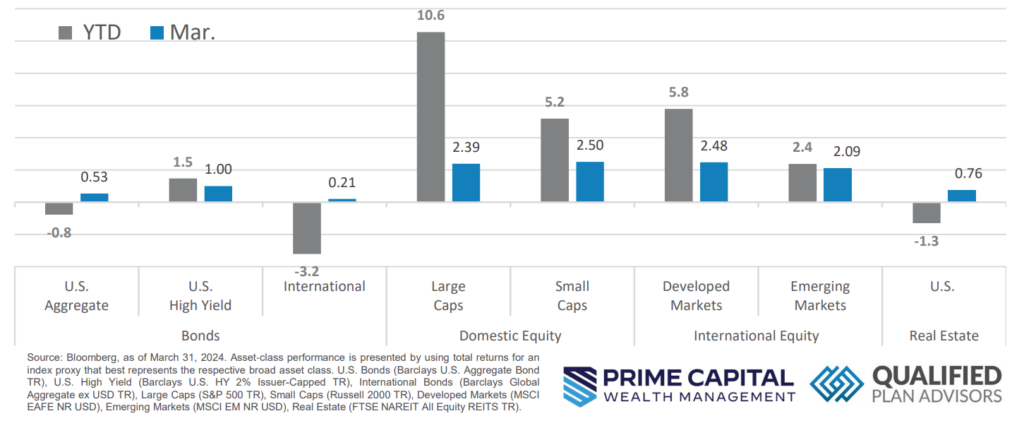

- Risk Assets Extended Their Upward Climb. All asset classes listed notched positive gains in March, helping pull year-to-date (YTD) figures for Real Estate, U.S. Aggregate Bonds, and International Bonds closer to positive territory.

- Inflation Eases in February. The Fed’s preferred inflation gauge, the PCE Deflator, saw a welcome slowdown in February, rising just 0.3% after a stronger January increase. This tamer reading contrasts with other inflation measures, which had suggested intensifying price pressures earlier in 2024.

- The Dollar Rallied Behind Poor Inflation Data. Disappointing inflation data triggered a rally in the dollar. This data strengthens the argument for the U.S. central bank to maintain current short-term interest rates, postponing any potential cuts.

- Labor Markets and Unemployment Rate. February’s strong jobs report hides a weaker market. Unemployment rose despite gains in just a few industries. Analysts see this as a trend, predicting a possible rate cut by the Fed in May to stimulate the economy. This could signal a slowdown for the economy.

Asset Class Performance

While Risk Asset Classes saw returns moderate in March compared to February, they maintained their positive trajectory following a sluggish start to the year. Leading the pack in March were Small Caps, Large Caps, and both Developed and Emerging Markets. Real Estate and the U.S. Aggregate Bond Market continued their ascent towards positive territory for the year on the back of a strong March performance.

Markets & Macroeconomics

February’s headline jobs report initially looked positive but revealed a different story with a closer look. While the headline number suggested strong hiring, the gains were concentrated in just a few industries. More importantly, the unemployment rate rose unexpectedly. This increase aligns with other indicators, like the household employment survey, which point to a looser labor market than previously thought. Analysts believe the February report provides a more accurate picture and expect future data to reflect this. The jump in unemployment is particularly concerning because it’s driven by layoffs, even with a growing number of job seekers. This aligns with the lower “quits rate” from the January JOLTS report, indicating employees are staying put and companies are hiring less. Additionally, a reliable model predicts a sharper rise in unemployment due to weaker wage growth, a sign of less worker bargaining power. While the model might overestimate the increase, it suggests unemployment will likely climb higher than the Fed’s year-end projection of 4.1%. Other indicators like rising claims and job-cut announcements further support this view of a cooling labor market. Given the unexpected cool-down in the labor market, analysts predict the Fed might cut interest rates sooner than anticipated. They expect a cut in May, as opposed to the current market expectation of June. The Fed has historically reacted quickly to negative labor market data, and this shift in perspective could influence their policy decisions. An earlier rate cut could be implemented to stimulate the economy.

Bottom Line: The Federal Reserve is facing a complex economic picture. While there’s positive news with inflation showing signs of decline, particularly in core spending prices, it’s not enough for them to consider lowering interest rates just yet. They’re looking for a clearer trend of sustained inflation reduction. However, the broader US economy seems to be on strong footing. Recent data shows significant growth in both GDP and GDI, indicating the economy is expanding at a healthy rate. Additionally, a narrowing gap between these two figures, which is important for gauging recessions, points towards a more optimistic outlook for the US.

©2023 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Sources for this market commentary derived from Bloomberg Asset-class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

© 2023 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.