Quick Takes

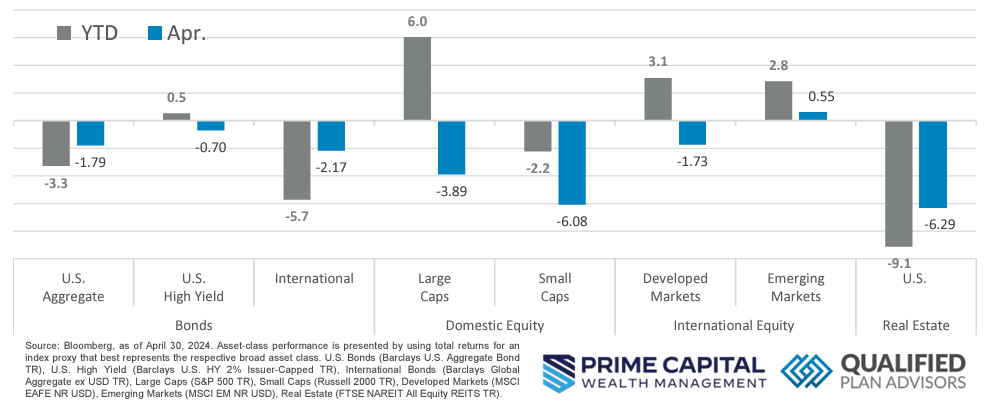

- Risk Assets Had a Challenging Month. Almost all asset classes saw a decrease in April except for Emerging Markets which posted a positive return. YTD figures took a hit this month after posting positive returns for most asset classes in March

- Inflation Surges in April. Last quarter, the U.S. saw economic growth decline and inflation surge, disrupting the previously optimistic outlook; GDP grew at 1.6%, lower than expected, personal spending rose slower at 2.5%, and the widening trade deficit significantly impacted growth, leading the Fed keeping interest rates unchanged

- The Dollar Lagged After Mixed Economic Data. The U.S. dollar weakened, except against the yen, due to unexpected economic slowdown and inflation acceleration, potentially complicating the Federal Reserve’s interest rate plans.

- Labor Costs Increase in Q1. Recent Bureau of Labor Statistics data indicates a notable Q1 increase in U.S. labor costs, surpassing forecasts. The 1.2% rise in the Employment Cost Index highlights persistent wage pressures driving inflation. Policymakers grapple with managing inflation amid high interest rates and no immediate plans for reduction.

Asset Class Performance

In April, Risk Asset Classes faced challenges, with all except Emerging Markets registering losses. Particularly noteworthy were the declines in Small Caps and Real Estate, which experienced significant downturns, resulting in YTD metrics shifting into negative territory. Despite the downturn, Developed Markets and Large Caps managed to maintain their positive YTD performance for the month.

Markets & Macroeconomics

The latest data from the Bureau of Labor Statistics reveals a notable uptick in U.S. labor costs during the first quarter, surpassing earlier projections. The Employment Cost Index (ECI), a key metric monitored by the Federal Reserve, rose by 1.2%, marking its most significant increase in a year. This surge underscores persistent wage pressures contributing to ongoing inflationary trends. The unexpected acceleration in labor costs has elicited varied market responses, with stockindex futures declining, Treasury yields climbing, and the dollar strengthening. These figures may intensify concerns among Fed policymakers regarding their efforts to rein in inflation, especially as they maintain interest rates at a two-decade high with no immediate plans for reduction. The rise in employment costs was widespread across sectors, with notable increases observed in public administration, hospitals, and manufacturing. Year-over-year, the ECI surged by 4.2%, consistent with the previous quarter’s annual increase. Additionally, the implications of this upward trend in labor costs extend beyond immediate market reactions, potentially influencing broader economic policies and corporate strategies. Policymakers and businesses alike may find themselves navigating heightened pressures to manage expenses and maintain competitiveness in a climate of escalating wage dynamics. In response, companies might explore strategies such as productivity improvements, workforce optimization, or adjustments in pricing strategies to mitigate the impact of rising labor costs on profitability and competitiveness.

Bottom Line: Recent data from the Bureau of Labor Statistics shows a significant increase in U.S. labor costs during the first quarter, exceeding expectations. The Employment Cost Index (ECI) rose by 1.2%, highlighting persistent wage pressures contributing to inflationary trends. This surge has triggered diverse market reactions, including declines in stock-index futures and increases in Treasury yields and the dollar’s strength. The upward trend in labor costs poses challenges for policymakers aiming to control inflation, especially with interest rates remaining high and no immediate plans for reduction.

©2024 Prime Capital Investment Advisors, LLC. The views and information contained herein are (1) for informational purposes only, (2) are not to be taken as a recommendation to buy or sell any investment, and (3) should not be construed or acted upon as individualized investment advice. The information contained herein was obtained from sources we believe to be reliable but is not guaranteed as to its accuracy or completeness. Investing involves risk. Investors should be prepared to bear loss, including total loss of principal. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Past performance is no guarantee of comparable future results.

Source: Sources for this market commentary derived from Bloomberg Asset-class performance is presented by using market returns from an exchange‐traded fund (ETF) proxy that best represents its respective broad asset class. Returns shown are net of fund fees for and do not necessarily represent performance of specific mutual funds and/or exchange-traded funds recommended by the Prime Capital Investment Advisors. The performance of those funds June be substantially different than the performance of the broad asset classes and to proxy ETFs represented here. U.S. Bonds (iShares Core U.S. Aggregate Bond ETF); High‐Yield Bond (iShares iBoxx $ High Yield Corporate Bond ETF); Intl Bonds (SPDR® Bloomberg Barclays International Corporate Bond ETF); Large Growth (iShares Russell 1000 Growth ETF); Large Value (iShares Russell 1000 Value ETF); Mid Growth (iShares Russell Mid-Cap Growth ETF); Mid Value (iShares Russell Mid-Cap Value ETF); Small Growth (iShares Russell 2000 Growth ETF); Small Value (iShares Russell 2000 Value ETF); Intl Equity (iShares MSCI EAFE ETF); Emg Markets (iShares MSCI Emerging Markets ETF); and Real Estate (iShares U.S. Real Estate ETF). The return displayed as “Allocation” is a weighted average of the ETF proxies shown as represented by: 30% U.S. Bonds, 5% International Bonds, 5% High Yield Bonds, 10% Large Growth, 10% Large Value, 4% Mid Growth, 4% Mid Value, 2% Small Growth, 2% Small Value, 18% International Stock, 7% Emerging Markets, 3% Real Estate.

Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., Suite#150, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated.

© 2024 Prime Capital Investment Advisors, 6201 College Blvd., Suite #150, Overland Park, KS 66211.